Are you a resident of New Jersey wondering how to get health insurance in New Jersey? Navigating the intricacies of the healthcare system can be overwhelming, but understanding the available options is the first step toward securing comprehensive coverage.

In this guide, we’ll delve into the various avenues for obtaining health insurance in the Garden State, from the state’s official marketplace to government programs like Medicaid and NJ FamilyCare, as well as private insurance options and employer-sponsored plans. By exploring these options and understanding the resources available, you can confidently navigate the process of obtaining health insurance in New Jersey.

Table of Contents

Understanding Health Insurance in New Jersey

Understanding health insurance in New Jersey is essential for residents looking to safeguard their well-being and manage healthcare expenses effectively. Health insurance serves as a vital financial tool that provides coverage for medical services, including doctor visits, hospital stays, prescription medications, and preventive care. Whether you’re a long-time resident or new to the state, navigating the intricacies of health insurance options can seem daunting, but with the right knowledge, individuals can make informed decisions tailored to their needs.

In New Jersey, health insurance coverage can be obtained through various avenues, including employer-sponsored plans, government programs like Medicaid and NJ FamilyCare (CHIP), and private health insurance plans. Each option has its own eligibility criteria, benefits, and costs, making it crucial for residents to understand the differences and choose the most suitable option for themselves and their families. By exploring the available options and understanding how they align with individual needs, residents can ensure access to quality healthcare coverage.

Understanding the importance of health insurance enrollment periods and deadlines is crucial in New Jersey. Open enrollment periods, typically occurring annually, provide individuals and families with the opportunity to enroll in or change their health insurance plans. Additionally, qualifying life events, such as marriage, birth of a child, or loss of other coverage, may trigger special enrollment periods, allowing individuals to make changes outside of the regular enrollment period. Being aware of these timelines and requirements ensures that residents can enroll in health insurance coverage when needed, without facing penalties or gaps in coverage.

New Jersey residents should familiarize themselves with key health insurance terms and concepts to make informed decisions about their coverage. Understanding terms like premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums can help individuals evaluate plan options and estimate their potential healthcare costs. Additionally, being aware of network providers and coverage limitations can ensure that individuals can access the care they need while minimizing out-of-pocket expenses. By arming themselves with knowledge about health insurance basics, residents can navigate the complexities of the healthcare system with confidence and peace of mind.

Exploring Your Health Insurance Options in New Jersey

Exploring health insurance options in New Jersey offers residents a range of choices tailored to their needs and circumstances. Whether through employer-sponsored plans, government programs, or private health insurance options, individuals and families have avenues to obtain comprehensive coverage. Understanding these options and their features is essential for making informed decisions about healthcare coverage in the Garden State. Below we will discuss all the potential health insurance options for New Jersey residents.

New Jersey’s Health Insurance Marketplace: Get Covered NJ

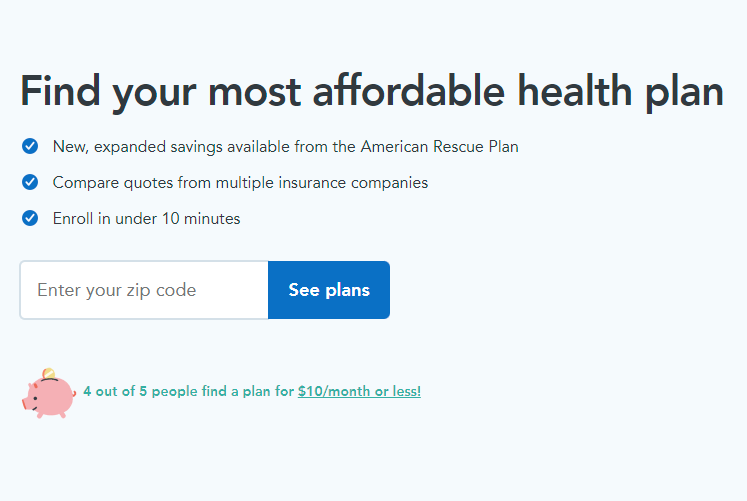

New Jersey’s Health Insurance Marketplace, known as Get Covered NJ, serves as a vital platform for individuals and families to access and enroll in health insurance plans. Operated through the federal exchange, Get Covered NJ offers a user-friendly interface where residents can explore various health insurance options, compare plans, and determine eligibility for financial assistance. The marketplace plays a crucial role in expanding access to affordable healthcare coverage for New Jersey residents.

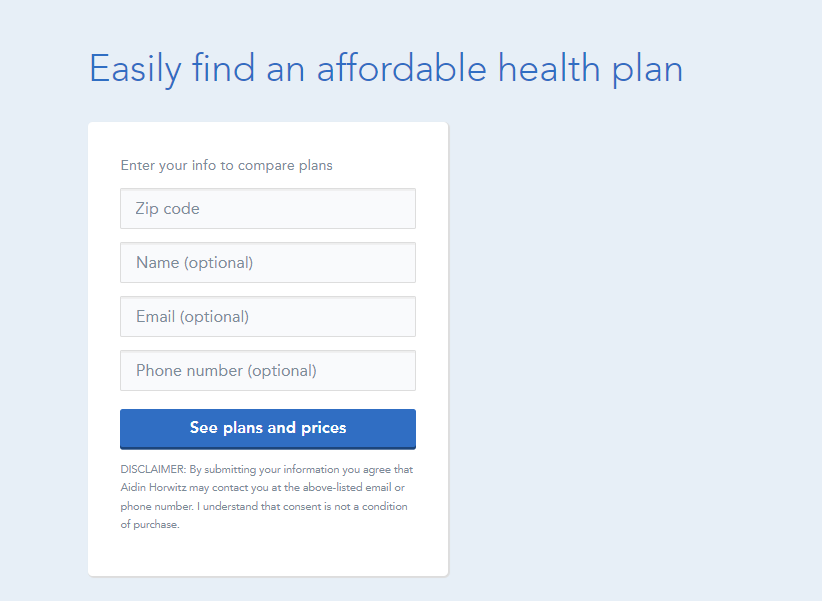

One of the key features of Get Covered NJ is its accessibility and ease of use. The online platform provides a centralized hub where individuals can shop for health insurance plans from multiple insurance providers. Residents can create accounts, enter basic information about their household, and view available plans tailored to their specific needs and preferences. Additionally, Get Covered NJ offers multilingual support and assistance for individuals who may need help navigating the enrollment process.

Get Covered NJ also provides financial assistance to eligible residents, making health insurance more affordable for those with limited incomes. Through the marketplace, individuals may qualify for premium tax credits and cost-sharing reductions, which help reduce monthly premiums and out-of-pocket expenses associated with healthcare services. By entering income and household information during the application process, residents can determine their eligibility for these subsidies and enroll in a plan that fits their budget.

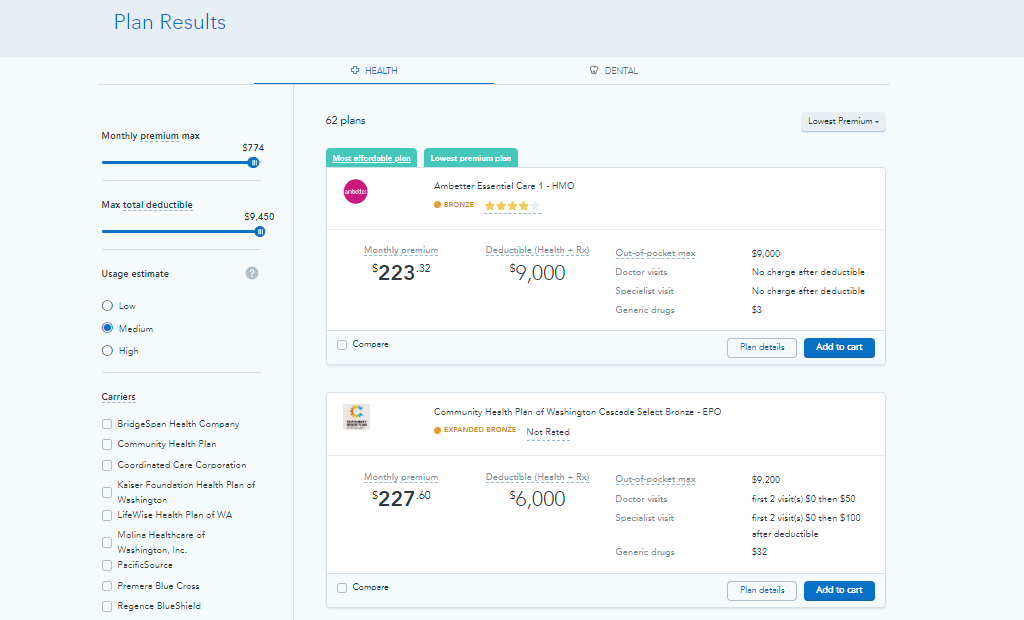

Get Covered NJ offers a range of health insurance plans from various insurance carriers, ensuring residents have access to diverse coverage options. Plans available through the marketplace include different levels of coverage, such as bronze, silver, gold, and platinum, each offering varying levels of premiums, deductibles, and cost-sharing arrangements. Residents can compare plans based on factors like coverage benefits, provider networks, and monthly premiums to find the plan that best meets their healthcare needs and financial situation.

For individuals and families seeking assistance with the enrollment process, Get Covered NJ provides access to certified navigators and assisters who offer personalized guidance and support. These trained professionals can help residents understand their coverage options, complete applications, and navigate any complexities or questions that may arise during the enrollment process. Additionally, Get Covered NJ hosts enrollment events and outreach activities to raise awareness about the importance of health insurance and help residents access coverage.

Get Covered NJ serves as a valuable resource for New Jersey residents seeking health insurance coverage. By providing a user-friendly platform, financial assistance options, and personalized support, the marketplace empowers individuals and families to make informed decisions about their healthcare coverage. Through Get Covered NJ, residents can access affordable and comprehensive health insurance plans that provide peace of mind and financial security for themselves and their loved ones.

For streamlined navigation and assistance with plan comparison and enrollment, New Hampshire residents can utilize online platforms like HealthSherpa. These resources provide tools and support to simplify the process of finding and applying for health insurance, helping individuals make informed decisions about their coverage needs and financial options.

Medicaid in New Jersey

Medicaid in New Jersey plays a pivotal role in providing essential healthcare coverage to low-income individuals and families across the state. Administered jointly by the federal government and the New Jersey Department of Human Services, Medicaid offers a comprehensive range of healthcare services, including doctor visits, hospital care, prescription medications, preventive screenings, and more, to eligible residents.

One of the defining features of Medicaid in New Jersey is its income-based eligibility criteria, which consider factors such as household size, income level, and citizenship status. The program extends coverage to individuals and families who meet specific income thresholds set by the state, ensuring that vulnerable populations have access to necessary medical care without facing financial hardship. Additionally, New Jersey has expanded its Medicaid program under the Affordable Care Act, broadening eligibility to include more low-income adults and providing coverage to thousands of previously uninsured individuals.

Enrolling in Medicaid in New Jersey is a straightforward process, with multiple avenues available for application. Residents can apply online through the NJ FamilyCare website, by phone, by mail, or in person at local county welfare agencies or federally qualified health centers. The application requires individuals to provide information about their household, income, assets, and citizenship status. Once approved, beneficiaries gain access to a network of healthcare providers who accept Medicaid insurance, ensuring that they can receive timely and quality medical care when needed.

Medicaid in New Jersey offers additional benefits and services beyond traditional medical care. These may include dental and vision care, mental health services, substance abuse treatment, long-term care, and home and community-based services for individuals with disabilities or chronic conditions. The program aims to promote overall health and well-being by addressing both medical and non-medical needs of its beneficiaries, thereby improving health outcomes and reducing healthcare disparities across the state.

Medicaid serves as a lifeline for thousands of New Jersey residents, providing them with access to affordable and comprehensive healthcare coverage. By expanding eligibility, offering essential benefits, and ensuring access to a network of healthcare providers, Medicaid plays a critical role in promoting the health and financial security of individuals and families throughout the state. For those in need of assistance or information about Medicaid eligibility and enrollment, resources are available through the NJ FamilyCare website, local community organizations, and county welfare agencies, helping residents access the coverage they need to protect their health and well-being.

NJ FamilyCare (CHIP)

NJ FamilyCare, New Jersey’s Children’s Health Insurance Program (CHIP), is a vital resource for families across the state, providing affordable healthcare coverage to children and some adults who do not qualify for Medicaid but still need assistance in accessing healthcare services. Administered by the New Jersey Department of Human Services, NJ FamilyCare offers comprehensive benefits to eligible individuals, including doctor visits, hospital care, prescription medications, preventive services, dental and vision care, and more.

One of the primary objectives of NJ FamilyCare is to ensure that all children in New Jersey have access to the healthcare services they need to grow and thrive. The program covers children under the age of 19 from low-income families, including those whose parents may not have access to employer-sponsored insurance or other forms of coverage. By providing comprehensive healthcare benefits, NJ FamilyCare helps families avoid the financial burden associated with medical expenses, ensuring that children receive the care they need to stay healthy and reach their full potential.

Eligibility for NJ FamilyCare is based on factors such as household income, family size, and citizenship status. The program extends coverage to children and some adults who meet specific income thresholds set by the state, ensuring that vulnerable populations have access to essential medical care without facing financial hardship. Additionally, NJ FamilyCare offers coverage for pregnant women, providing prenatal and postpartum care to ensure healthy outcomes for mothers and babies.

Enrolling in NJ FamilyCare is a straightforward process, with multiple avenues available for application. Families can apply online through the NJ FamilyCare website, by phone, by mail, or in person at local county welfare agencies or community organizations. The application requires individuals to provide information about their household, income, assets, and citizenship status. Once approved, beneficiaries gain access to a network of healthcare providers who accept NJ FamilyCare insurance, ensuring that children and families can access timely and quality medical care when needed.

NJ FamilyCare plays a crucial role in promoting the health and well-being of children and families in New Jersey, providing them with access to affordable and comprehensive healthcare coverage. By offering essential benefits, simplifying the enrollment process, and ensuring access to a network of healthcare providers, NJ FamilyCare helps families navigate the complexities of the healthcare system with confidence and peace of mind. For those in need of assistance or information about NJ FamilyCare eligibility and enrollment, resources are available through the NJ FamilyCare website, local community organizations, and county welfare agencies, ensuring that every eligible individual can access the coverage they need to protect their health and financial security.

Medicare in New Jersey

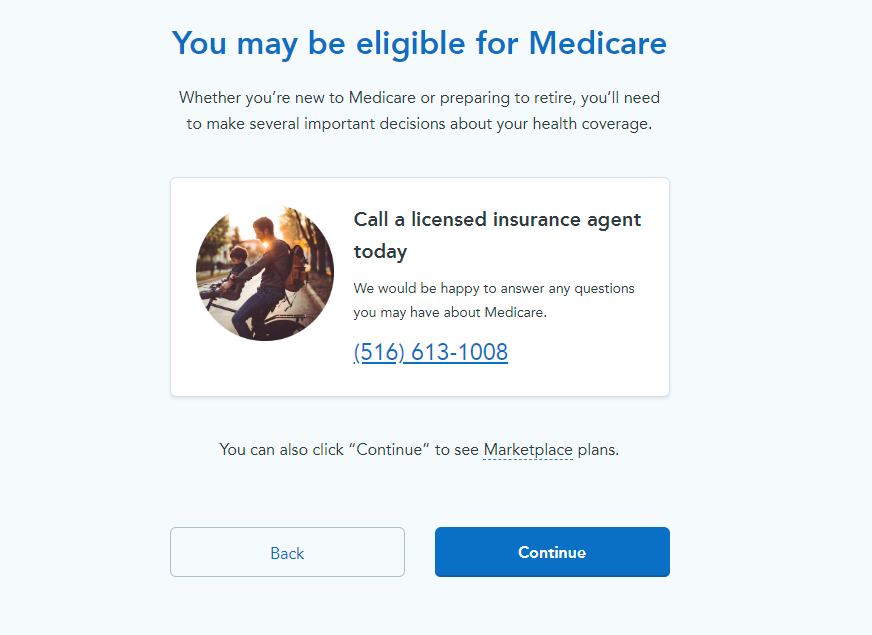

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older, as well as certain younger people with disabilities and those with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). In New Jersey, Medicare serves as a crucial resource for older adults and individuals with disabilities, offering a range of benefits to help cover healthcare costs. The program consists of several parts, each covering different aspects of healthcare services.

Part A of Medicare, also known as Hospital Insurance, helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Part B, or Medical Insurance, covers services from doctors and other healthcare providers, outpatient care, home health care, durable medical equipment, and certain preventive services. Additionally, Medicare Advantage plans, offered by private insurance companies approved by Medicare, provide all Part A and Part B coverage, and often include extra benefits such as prescription drug coverage (Part D), vision, dental, and hearing services.

Medicare enrollment typically begins three months before an individual’s 65th birthday and extends for seven months thereafter. For those who are eligible due to disability, enrollment occurs automatically after receiving Social Security Disability Insurance (SSDI) benefits for 24 months. It’s essential for New Jersey residents approaching Medicare eligibility to explore their options and understand the coverage available to them, whether through original Medicare or Medicare Advantage plans.

Individuals already enrolled in Medicare should review their coverage annually during the open enrollment period (October 15 to December 7) to ensure their plan still meets their healthcare needs and budget. By understanding the various parts of Medicare and how they work, beneficiaries in New Jersey can make informed decisions to access the healthcare services they need with confidence and security.

Medicare beneficiaries in New Jersey have access to various resources and support services to help them navigate their coverage and make informed healthcare decisions. Local organizations, such as the State Health Insurance Assistance Program (SHIP) and community health centers, provide counseling and assistance to Medicare beneficiaries, helping them understand their coverage options, navigate enrollment, and resolve issues related to billing or claims.

Online resources like the Medicare website offer valuable information and tools to help beneficiaries find and compare Medicare plans, locate healthcare providers, and access important benefits and services. By leveraging these resources and staying informed about their coverage options, Medicare beneficiaries in New Jersey can make the most of their benefits and ensure they receive the care they need to maintain their health and well-being.

Or Call (833) 703-2758

Employer-Sponsored Insurance in New Jersey

Employer-sponsored insurance (ESI) plays a significant role in providing health coverage for individuals and families in New Jersey. Many employers in the state offer health insurance benefits as part of their employee compensation packages, helping workers access essential healthcare services. ESI plans vary widely in terms of coverage, cost, and provider networks, depending on the employer’s size, industry, and specific plan offerings.

In New Jersey, employers with 50 or more full-time equivalent employees are typically required to offer health insurance coverage to their employees under the Affordable Care Act (ACA). However, many smaller employers also voluntarily provide health insurance benefits to attract and retain talent. ESI plans often cover a range of services, including doctor visits, hospital stays, prescription medications, preventive care, and more, offering comprehensive coverage to employees and their families.

Employees enrolled in ESI plans in New Jersey usually share the cost of premiums with their employers, with the employer typically contributing a portion of the premium cost. Additionally, employees may have out-of-pocket costs such as deductibles, copayments, and coinsurance when accessing healthcare services. It’s essential for employees to carefully review their ESI plan options during the annual open enrollment period or when initially eligible for coverage, considering factors like cost, coverage network, and benefit offerings. By understanding their employer-sponsored insurance options, employees in New Jersey can make informed decisions to secure comprehensive health coverage for themselves and their families while maximizing the benefits provided by their employers.

Employer-sponsored insurance offers stability and continuity of coverage for individuals and families, as it is often provided on a group basis and remains in effect as long as the individual remains employed by the sponsoring employer. Additionally, ESI plans may offer benefits such as wellness programs, telemedicine services, and health savings accounts (HSAs) or flexible spending accounts (FSAs) to help employees manage their healthcare costs and promote overall well-being. For many New Jersey residents, employer-sponsored insurance represents a valuable benefit that provides access to quality healthcare coverage and peace of mind for themselves and their families.

If you are employed, you should speak with your employer to better understand your options. If you do not have access to employer-sponsored insurance or don’t want to go that route, no worries, the options above can be a great alternative.

Private Health Insurance Plans

Private health insurance plans offer individuals and families in New Jersey a range of options for securing comprehensive healthcare coverage tailored to their specific needs. These plans, offered by private insurance companies, come in various forms, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs), each with its own set of benefits, costs, and provider networks.

To obtain private health insurance in New Jersey, individuals can explore different options available through insurance carriers’ websites or by contacting insurance agents or brokers directly. Many insurance companies offer online tools and resources that allow consumers to compare plans, estimate costs, and enroll in coverage conveniently. By visiting the websites of insurance carriers operating in New Jersey, individuals can view plan options, review coverage details, and obtain quotes based on their specific needs and preferences.

When selecting a private health insurance plan in New Jersey, it’s essential to carefully consider factors such as premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums. Individuals should assess their healthcare needs, anticipated medical expenses, and budget constraints to choose a plan that offers the right balance of coverage and cost. Additionally, evaluating the provider network associated with each plan is crucial to ensure access to preferred doctors, specialists, and healthcare facilities.

Individuals can seek assistance from insurance agents or brokers who can provide personalized guidance and help navigate the complexities of the private health insurance market. These professionals can offer insights into plan features, coverage options, and cost-sharing arrangements, enabling consumers to make informed decisions about their healthcare coverage. By leveraging the expertise of insurance professionals and utilizing online resources provided by insurance carriers, individuals and families in New Jersey can find a private health insurance plan that meets their needs and offers peace of mind for their healthcare journey.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan is a crucial decision that requires careful consideration of various factors to ensure you have adequate coverage for your healthcare needs. Here are some key steps to help you navigate the process and select the best plan for you and your family:

- Assess Your Healthcare Needs:

- Start by evaluating your healthcare needs, including the frequency of doctor visits, any ongoing medical conditions, prescription medications, and anticipated medical expenses.

- Consider factors such as your age, lifestyle, family size, and any expected changes in your healthcare needs in the coming year.

- Understand Plan Types:

- Familiarize yourself with different types of health insurance plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs).

- Understand how each plan type works, including the provider network, cost-sharing arrangements, and coverage limitations.

- Compare Coverage Options:

- Review the coverage details of each plan, including benefits, deductibles, copayments, coinsurance, and out-of-pocket maximums.

- Consider essential health benefits covered by each plan, such as preventive care, prescription drugs, mental health services, and maternity care.

- Evaluate Provider Networks:

- Check the provider network associated with each plan to ensure your preferred doctors, specialists, and healthcare facilities are included.

- Consider the accessibility and quality of healthcare providers within each network, as well as any out-of-network coverage options.

- Consider Cost and Affordability:

- Compare the premiums, deductibles, and out-of-pocket costs associated with each plan.

- Evaluate your budget and financial situation to determine what you can afford in terms of monthly premiums and potential healthcare expenses.

- Review Additional Benefits:

- Look for additional benefits or value-added services offered by each plan, such as telemedicine services, wellness programs, or discounts on gym memberships.

- Consider how these additional benefits align with your healthcare preferences and lifestyle.

- Seek Professional Guidance:

- Consult with insurance agents, brokers, or financial advisors who can provide personalized assistance and help you understand your options.

- Take advantage of online resources, such as plan comparison tools and calculators, offered by insurance carriers and government websites.

- Consider Long-Term Needs:

- Think about your long-term healthcare needs and any life changes that may impact your coverage requirements, such as marriage, childbirth, or retirement.

- Choose a plan that offers flexibility and options for adjusting coverage as your healthcare needs evolve over time.

By carefully weighing these factors and conducting thorough research, you can select a health insurance plan in New Jersey that meets your specific needs, provides adequate coverage, and offers peace of mind for you and your family’s healthcare journey.

Additional Resources for New Jersey Residents

In New Jersey, residents have access to various resources and programs designed to help them navigate the complexities of obtaining health insurance. Whether you’re looking for assistance with enrollment, understanding your coverage options, or accessing affordable healthcare services, there are several resources available to support you in securing the right health insurance plan. Here are some additional resources for New Jersey residents:

- Get Covered NJ:

- Get Covered NJ is the state’s official health insurance marketplace, where individuals and families can shop for and enroll in health insurance plans that meet their needs and budget. The website offers valuable information on coverage options, financial assistance programs, and enrollment deadlines.

- Visit the Get Covered NJ website to explore available health insurance plans, calculate subsidy eligibility, and find enrollment assistance locations near you.

- NJ FamilyCare:

- NJ FamilyCare is New Jersey’s publicly funded health insurance program that provides low-cost or no-cost health coverage to eligible residents, including children, pregnant women, parents, and adults without dependent children.

- Learn more about NJ FamilyCare eligibility requirements, benefits, and how to apply by visiting the program’s website or contacting the NJ FamilyCare hotline.

- Local Assistance Programs:

- Many community organizations, nonprofit agencies, and healthcare advocacy groups in New Jersey offer enrollment assistance and education on health insurance options. These organizations provide personalized support to individuals and families seeking guidance on selecting and enrolling in a health insurance plan.

- Search online or contact local community centers and healthcare organizations to inquire about available assistance programs in your area.

- State and County Health Departments:

- The New Jersey Department of Health and county health departments provide valuable resources and information on public health initiatives, healthcare services, and insurance programs available to residents.

- Visit the New Jersey Department of Health website or contact your county health department for assistance with health insurance-related inquiries and referrals to additional support services.

- Insurance Agents and Brokers:

- Licensed insurance agents and brokers can offer personalized guidance and assistance with navigating the health insurance marketplace, comparing plan options, and enrolling in coverage.

- Consider consulting with an insurance agent or broker who specializes in health insurance to receive expert advice tailored to your specific needs and preferences.

- Online Resources and Tools:

- Take advantage of online resources and tools provided by government agencies, insurance carriers, and healthcare organizations to research health insurance options, estimate costs, and access educational materials.

- Explore websites such as HealthCare.gov, the official federal health insurance marketplace, and the New Jersey Department of Banking and Insurance for valuable information and resources on obtaining health insurance in New Jersey.

- For streamlined navigation and assistance with plan comparison and enrollment, New Hampshire residents can utilize online platforms like HealthSherpa. These resources provide tools and support to simplify the process of finding and applying for health insurance.

Conclusion: How to Get Health Insurance in New Jersey with Confidence

Navigating the process of obtaining health insurance in New Jersey can seem daunting, but with the right resources and information, residents can approach it with confidence. Understanding the various options available, including the state’s marketplace, Medicaid, NJ FamilyCare, Medicare, and employer-sponsored plans, is crucial for making informed decisions about coverage. By exploring these avenues and utilizing additional resources such as local organizations and insurance professionals, individuals can find the right health insurance plan to meet their needs.

Staying informed about how to get health insurance in New Jersey empowers residents to take control of their healthcare journey. Whether seeking financial assistance through subsidies or understanding eligibility criteria for government programs, being knowledgeable about available resources is key. Additionally, leveraging online platforms and tools provided by the state’s marketplace can simplify the process of comparing plans and enrolling in coverage.

Ultimately, by accessing the wealth of information and support available, New Jersey residents can navigate the complexities of the healthcare system and secure the coverage they need to protect their health and financial well-being. By taking advantage of these resources and understanding the various options available, individuals and families can make informed decisions about their healthcare coverage, ensuring access to quality care when needed.