Navigating the landscape of healthcare coverage can be complex, but understanding how to get health insurance in Nebraska is essential for ensuring access to quality care. In this comprehensive guide, we’ll explore the various options available to Nebraska residents, providing insights into Nebraska’s Health Insurance Marketplace, Medicaid, CHIP, Medicare, employer-sponsored insurance, and private health insurance plans.

By delving into these options and understanding their eligibility criteria, coverage benefits, and application processes, individuals and families can make informed decisions about their healthcare coverage. At the end, we’ll highlight additional resources available to Nebraska residents, empowering them to navigate the intricacies of the healthcare system with confidence and peace of mind.

Table of Contents

Understanding Health Insurance in Nebraska

Navigating the realm of health insurance in Nebraska is essential for ensuring access to quality healthcare coverage. Whether you’re a long-time resident or new to the state, understanding your options is key. Health insurance serves as a vital safety net, covering everything from routine doctor visits to unexpected medical emergencies. In Nebraska, residents have access to a variety of health insurance plans tailored to individual needs and circumstances.

It’s important to familiarize yourself with the different types of coverage available. From employer-sponsored plans to private insurance options and government programs like Medicaid and CHIP, there are various avenues to explore. Each option has its own eligibility requirements, coverage benefits, and cost-sharing arrangements. By understanding these nuances, individuals can make informed decisions about their healthcare coverage.

Moreover, being aware of resources like Nebraska’s Health Insurance Marketplace can simplify the process of obtaining coverage. This centralized platform allows residents to compare plans, access financial assistance, and enroll in a plan that suits their needs and budget. By understanding the landscape of health insurance in Nebraska, individuals can navigate the system with confidence, ensuring they have the coverage they need to protect their health and well-being.

Exploring Your Health Insurance Options in Nebraska

Exploring your health insurance options in Nebraska provides a pathway to finding the coverage that best fits your needs and circumstances. With a range of options available, including employer-sponsored plans, private insurance, and government programs, residents have the opportunity to choose a plan that aligns with their healthcare needs and financial situation. Below we will discuss all the potential health insurance options for Nebraska residents.

Nebraska’s Health Insurance Marketplace

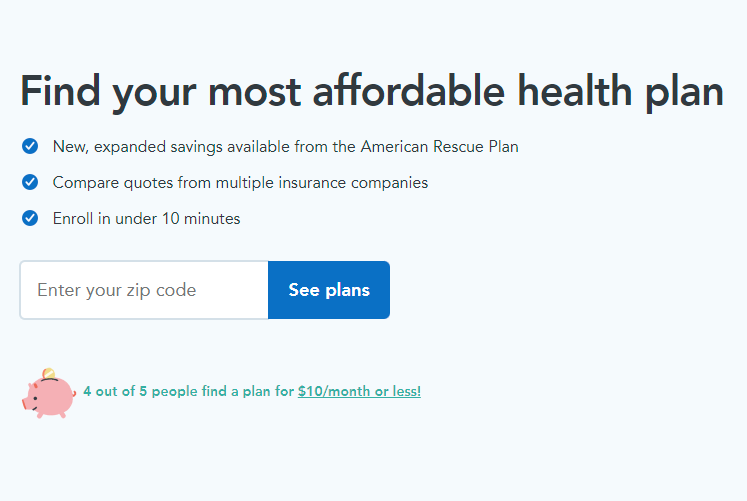

Nebraska’s Health Insurance Marketplace serves as a vital resource for individuals and families seeking comprehensive healthcare coverage. As a centralized platform operated through the federal exchange, the marketplace offers a diverse range of health insurance plans from various providers. It provides a convenient avenue for Nebraskans to explore, compare, and purchase plans tailored to their specific needs and preferences.

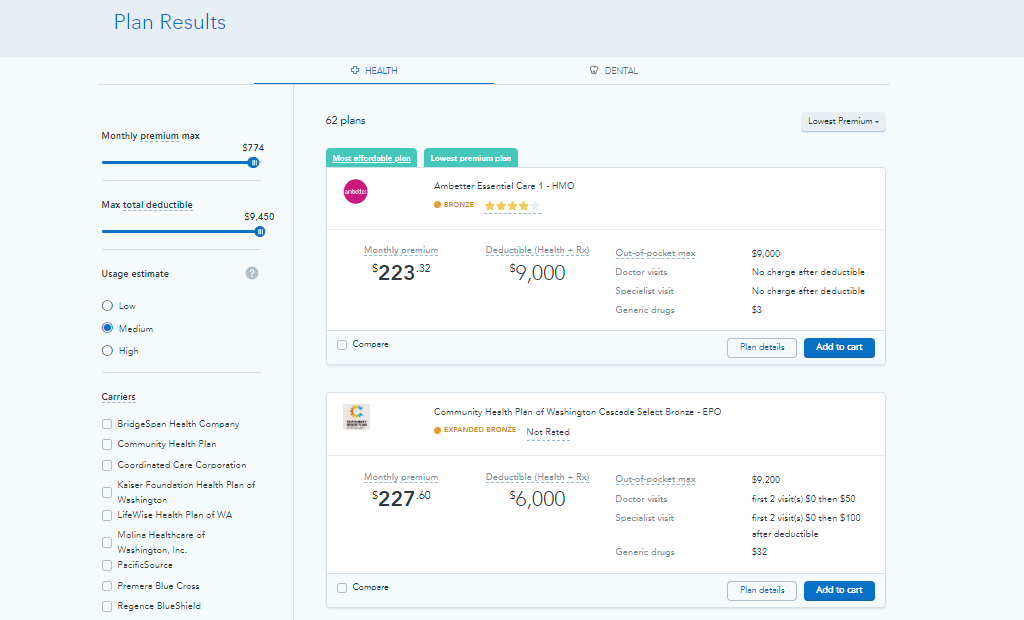

One of the primary advantages of Nebraska’s Health Insurance Marketplace is its ability to offer transparency and choice to consumers. By accessing the marketplace’s online platform, residents can easily compare different plans based on factors such as coverage benefits, premiums, deductibles, and provider networks. This transparency empowers individuals to make informed decisions about their healthcare coverage, ensuring they select a plan that aligns with their healthcare needs and budget.

Moreover, Nebraska’s Health Insurance Marketplace provides financial assistance to eligible individuals and families, making health insurance more affordable for those who qualify. Through subsidies and tax credits, the marketplace helps reduce the cost of monthly premiums, making coverage accessible to a broader segment of the population. By leveraging these financial assistance programs, Nebraskans can obtain quality health insurance coverage without placing undue strain on their finances.

Overall, Nebraska’s Health Insurance Marketplace plays a crucial role in facilitating access to healthcare coverage for residents across the state. Whether you’re seeking individual or family coverage, exploring the marketplace allows you to navigate the complexities of the insurance landscape with confidence. With its user-friendly interface, transparent pricing, and financial assistance options, the marketplace empowers Nebraskans to take control of their healthcare journey and secure coverage that meets their needs.

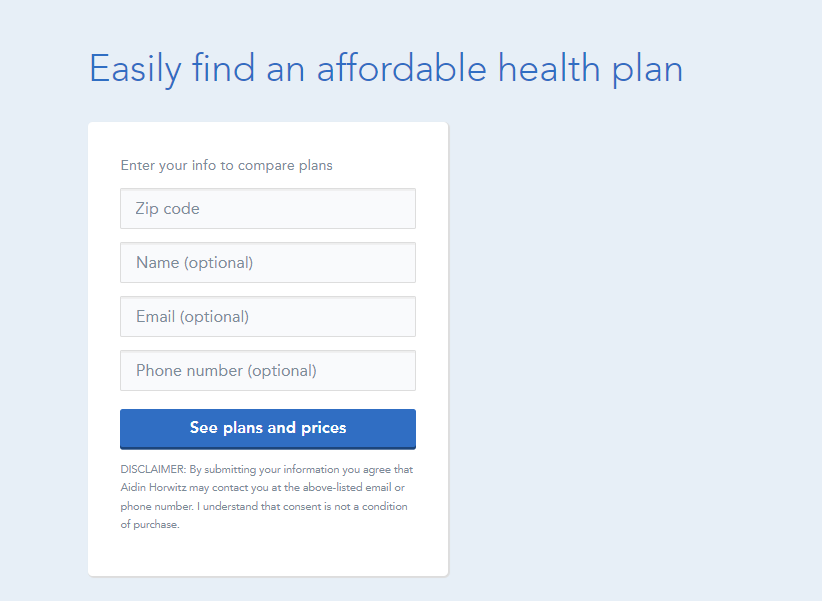

For individuals seeking additional support in navigating Nebraska’s Health Insurance Marketplace, resources like HealthSherpa can be invaluable. These are online platforms that allow users to compare health insurance plans, estimate subsidy eligibility, and complete the enrollment process with ease.

Medicaid in Nebraska

Medicaid in Nebraska serves as a lifeline for low-income individuals and families, ensuring access to essential healthcare services that might otherwise be financially out of reach. Administered jointly by the federal and state governments, Medicaid offers a comprehensive range of benefits, including doctor visits, hospital stays, prescription medications, preventive care, and more. This program plays a vital role in safeguarding the health and well-being of vulnerable populations across the state.

One of the key features of Medicaid in Nebraska is its income-based eligibility criteria, which consider factors such as household size, income level, and citizenship status when determining eligibility. The program extends coverage to individuals and families who meet specific income thresholds set by the state, providing them with access to quality healthcare coverage at little to no cost. Additionally, Nebraska has expanded its Medicaid program under the Affordable Care Act, broadening eligibility criteria to include more low-income adults who were previously uninsured.

Enrolling in Medicaid in Nebraska is a straightforward process, with multiple avenues available for application. Residents can apply online through the state’s Medicaid portal, by mail, or in-person at local Medicaid offices or community organizations. Once enrolled, beneficiaries gain access to a network of healthcare providers who accept Medicaid insurance, ensuring they can receive timely and quality medical care when needed. Overall, Medicaid serves as a vital safety net for thousands of Nebraskans, providing them with peace of mind and financial security knowing that their healthcare needs are covered, regardless of their income level or health status.

Children’s Health Insurance Program (CHIP) in Nebraska

The Children’s Health Insurance Program (CHIP) in Nebraska is a crucial resource aimed at providing affordable healthcare coverage to children in low-income families across the state. Administered by the Nebraska Department of Health and Human Services, CHIP offers comprehensive health benefits to children under the age of 19, ensuring they have access to essential medical services such as doctor visits, immunizations, hospital care, prescription medications, and more. This program serves as a vital safety net for families who may not qualify for Medicaid but still need assistance in covering their children’s healthcare expenses.

Applying for CHIP in Nebraska is a straightforward process designed to ensure that eligible children can access the coverage they need to stay healthy and thrive. Families can apply for CHIP online through the ACCESSNebraska website, which provides a user-friendly portal for submitting applications and accessing information about available benefits. Additionally, paper applications are available for those who prefer to apply by mail or in-person at local Department of Health and Human Services offices or community organizations.

To apply for CHIP, families will need to provide information about household income, family size, and citizenship or immigration status for each child seeking coverage. Once the application is submitted, it will be reviewed by the Department of Health and Human Services to determine eligibility for the program. If approved, families will receive notification of their child’s enrollment in CHIP and information about how to access healthcare services through the program.

Overall, CHIP plays a critical role in ensuring that children across Nebraska have access to the healthcare services they need to grow and thrive. By providing comprehensive coverage at an affordable cost, CHIP helps families avoid the financial burden associated with medical expenses, ensuring that children can receive the care they need to lead healthy and active lives.

Medicare in Nebraska

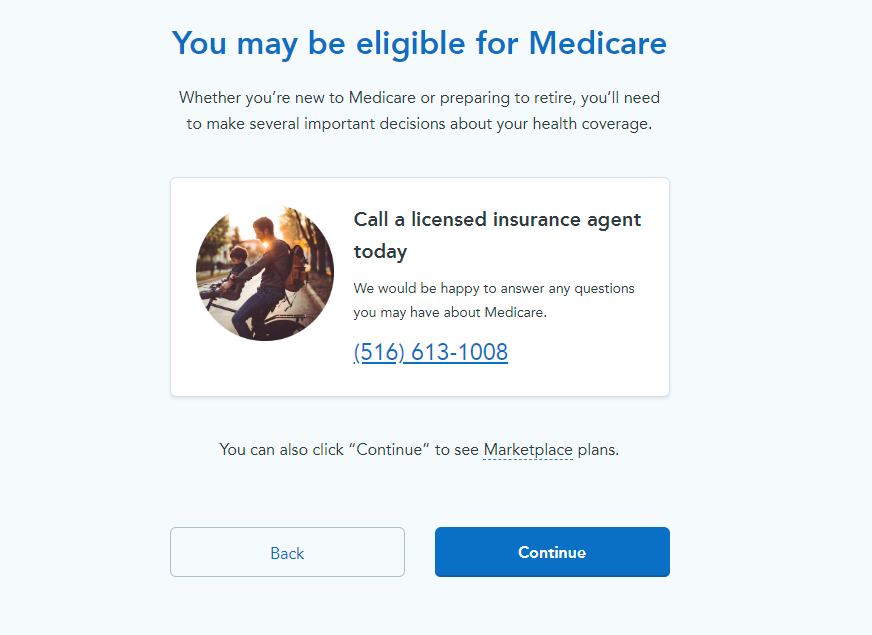

Medicare in Nebraska serves as a lifeline for many older adults and individuals with disabilities, offering essential healthcare coverage to meet their medical needs. As a federal health insurance program, Medicare provides coverage for individuals aged 65 and older, certain younger people with disabilities, and those with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). Understanding the intricacies of Medicare is crucial for beneficiaries to make informed decisions about their healthcare coverage and access the services they need to maintain their health and well-being.

There are several parts to Medicare, each covering different aspects of healthcare services. Part A, also known as Hospital Insurance, helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Part B, or Medical Insurance, covers services from doctors and other healthcare providers, outpatient care, home health care, durable medical equipment, and certain preventive services. Additionally, Medicare Advantage plans, offered by private insurance companies approved by Medicare, provide all Part A and Part B coverage and often include extra benefits such as prescription drug coverage (Part D), vision, dental, and hearing services.

Medicare enrollment typically begins three months before an individual’s 65th birthday and extends for seven months thereafter. For those who are eligible due to disability, enrollment occurs automatically after receiving Social Security Disability Insurance (SSDI) benefits for 24 months. It’s essential for Nebraska residents approaching Medicare eligibility to explore their options and understand the coverage available to them, whether through original Medicare or Medicare Advantage plans. Additionally, individuals already enrolled in Medicare should review their coverage annually during the open enrollment period (October 15 to December 7) to ensure their plan still meets their healthcare needs and budget.

Nebraska residents have access to a wide range of healthcare providers who accept Medicare insurance, ensuring that beneficiaries can receive timely and quality medical care when needed. From primary care physicians to specialists, hospitals, and other healthcare facilities, Medicare provides beneficiaries with the flexibility to choose the providers and services that best meet their individual healthcare needs. Moreover, Medicare Advantage plans may offer additional benefits such as wellness programs, telemedicine services, and prescription drug coverage, providing beneficiaries with comprehensive care and support to maintain their health and well-being.

Navigating the complexities of Medicare can be challenging, but beneficiaries in Nebraska have access to resources and support to help them understand their coverage options and make informed decisions about their healthcare. Organizations such as the Nebraska Senior Health Insurance Information Program (SHIIP) offer free, unbiased counseling to help beneficiaries understand their Medicare benefits, compare plans, and navigate the enrollment process. Additionally, online resources, educational materials, and informational seminars provide valuable information to help beneficiaries make the most of their Medicare coverage and ensure they receive the care they need to stay healthy and active.

Or Call (833) 703-2758

Employer-Sponsored Insurance in Nebraska

Employer-sponsored insurance (ESI) is a significant component of the healthcare landscape in Nebraska, providing health coverage for many individuals and families across the state. Many employers in Nebraska offer health insurance benefits as part of their employee compensation packages, aiming to attract and retain talent while ensuring access to essential healthcare services for their workforce.

In Nebraska, employers with 50 or more full-time equivalent employees are typically required to offer health insurance coverage to their employees under the Affordable Care Act (ACA). However, many smaller employers also voluntarily provide health insurance benefits to their employees as part of their overall compensation package. ESI plans can vary widely in terms of coverage, cost, and provider networks, depending on factors such as the size of the employer, industry, and specific plan offerings.

Employees enrolled in ESI plans in Nebraska usually share the cost of premiums with their employers, with the employer typically contributing a portion of the premium cost. Additionally, employees may have out-of-pocket costs such as deductibles, copayments, and coinsurance when accessing healthcare services. It’s essential for employees to carefully review their ESI plan options during the annual open enrollment period or when initially eligible for coverage, considering factors like cost, coverage network, and benefit offerings.

ESI plans in Nebraska often cover a range of services, including doctor visits, hospital stays, prescription medications, preventive care, and more, offering comprehensive coverage to employees and their families. By accessing health insurance through their employer, individuals and families can benefit from group purchasing power, potentially resulting in lower premiums and broader coverage options compared to individual plans.

Employer-sponsored insurance plays a vital role in providing health coverage for individuals and families in Nebraska, offering comprehensive benefits and access to a network of healthcare providers. By carefully evaluating their ESI plan options and understanding the coverage available to them, employees can make informed decisions to secure comprehensive health coverage for themselves and their families while maximizing the benefits provided by their employers.

If you are employed, you should speak with your employer to better understand your options. If you do not have access to employer-sponsored insurance or don’t want to go that route, no worries, the options above can be a great alternative.

Private Health Insurance Plans

Private health insurance plans in Nebraska offer individuals and families a diverse range of options for securing comprehensive healthcare coverage tailored to their specific needs. These plans, offered by private insurance companies, come in various forms, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs), each with its own set of benefits, costs, and provider networks.

To obtain private health insurance in Nebraska, individuals can explore different options available through insurance carriers’ websites. Insurance carriers typically offer detailed information about their available plans, including coverage options, premiums, deductibles, copayments, and provider networks. By visiting the websites of insurance carriers operating in Nebraska, individuals can review plan details, compare options, and determine which plan best meets their healthcare needs and budget constraints.

Moreover, some insurance carriers may offer online tools and resources to help individuals navigate the process of selecting a health insurance plan. These tools may include plan comparison tools, cost calculators, and enrollment portals, allowing consumers to explore their options, estimate costs, and enroll in coverage online. By leveraging these online resources, individuals can streamline the process of finding and applying for health insurance, ensuring they have the coverage they need to protect their health and financial well-being.

Additionally, individuals can seek assistance from insurance brokers or agents who specialize in health insurance. Insurance brokers can provide personalized guidance and support, helping individuals understand their coverage options, navigate the enrollment process, and find a plan that aligns with their healthcare needs and budget. By working with an insurance broker, individuals can access expert advice and support to make informed decisions about their health insurance coverage.

Obtaining private health insurance in Nebraska involves exploring the options available from insurance carriers, reviewing plan details and costs, and selecting a plan that meets individual healthcare needs and budget constraints. Whether by visiting insurance carriers’ websites, utilizing online tools and resources, or seeking assistance from insurance brokers, individuals can navigate the process of obtaining private health insurance with confidence and peace of mind.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan is a crucial decision that requires careful consideration of various factors to ensure that it meets your specific healthcare needs and financial situation. Here’s a detailed guide to help you navigate the process:

- Assess Your Healthcare Needs: Start by evaluating your current health status, any ongoing medical conditions, and anticipated healthcare needs for the upcoming year. Consider factors such as prescription medications, doctor visits, specialist care, and any planned medical procedures. This assessment will help you determine the level of coverage you require from your health insurance plan.

- Understand Plan Types: Familiarize yourself with the different types of health insurance plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs). Each plan type has its own network of healthcare providers, coverage options, and cost-sharing structures, so understanding their differences is essential in making an informed decision.

- Compare Coverage Options: Review the coverage details of each health insurance plan, including benefits, exclusions, and limitations. Pay attention to essential health services such as preventive care, prescription drugs, mental health services, maternity care, and emergency care. Consider whether the plan covers services from your preferred healthcare providers and facilities, and assess the level of coverage for out-of-network care if needed.

- Evaluate Cost-sharing Features: Understand the cost-sharing features of each health insurance plan, including premiums, deductibles, copayments, and coinsurance. Evaluate how these costs will impact your budget and healthcare expenses throughout the year. Plans with lower premiums may have higher out-of-pocket costs when you need care, while plans with higher premiums may offer more comprehensive coverage and lower out-of-pocket expenses.

- Consider Additional Benefits: Take into account any additional benefits or value-added services offered by the health insurance plan. Some plans may include telemedicine services, wellness programs, alternative medicine coverage, or discounts on gym memberships. Assess whether these additional benefits align with your healthcare preferences and lifestyle.

- Review Provider Networks: Check the provider network of each health insurance plan to ensure that your preferred healthcare providers, including doctors, specialists, hospitals, and clinics, are included in the network. Consider the accessibility and quality of care offered by network providers, as well as any restrictions or requirements for obtaining services from out-of-network providers.

- Estimate Total Costs: Calculate the total cost of each health insurance plan, including premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums. Use online calculators or tools provided by insurance carriers to estimate your total healthcare expenses under each plan based on your anticipated usage. Compare these estimates to determine which plan offers the best value for your healthcare needs and budget.

- Review Plan Documents: Carefully review the Summary of Benefits and Coverage (SBC) and other plan documents provided by each health insurance plan. Pay attention to details such as coverage limits, exclusions, preauthorization requirements, and appeals processes. Understand your rights and responsibilities as a plan member, and ask questions if any information is unclear.

- Seek Expert Advice: Consider consulting with an insurance broker or agent who can provide personalized guidance and support in selecting a health insurance plan. Insurance professionals can help you understand your coverage options, navigate the enrollment process, and clarify any questions or concerns you may have. Take advantage of their expertise to make an informed decision that aligns with your healthcare needs and financial goals.

- Review Annually: Remember that healthcare needs can change over time, so it’s essential to review your health insurance coverage annually during the open enrollment period. Assess whether your current plan still meets your needs and consider any changes in your healthcare usage, budget, or life circumstances. Be proactive in adjusting your coverage as needed to ensure ongoing protection for yourself and your family.

By following these steps and conducting thorough research, you can choose a health insurance plan in Nebraska that provides comprehensive coverage and peace of mind for you and your loved ones.

Additional Resources for Nebraska Residents

Nebraska residents have a wealth of additional resources available to assist them in navigating the process of obtaining health insurance and accessing healthcare services. These resources are essential for individuals and families seeking guidance, support, and information tailored to their specific needs. Here are some valuable additional resources for Nebraska residents looking to understand how to get health insurance in Nebraska:

- Nebraska Department of Insurance: The Nebraska Department of Insurance serves as a primary resource for residents seeking information and assistance regarding health insurance options in the state. Through their website and helpline, individuals can access educational materials, consumer guides, and personalized assistance to understand their coverage options, compare plans, and make informed decisions about health insurance enrollment.

- Legal Aid of Nebraska: Legal Aid of Nebraska offers free legal assistance to low-income individuals and families facing healthcare-related legal issues. Residents can seek support with matters such as denied insurance claims, eligibility disputes, and access to Medicaid or other public health programs. By contacting Legal Aid of Nebraska, residents can receive legal advice, representation, and advocacy services to ensure their rights are protected in matters related to health insurance.

- Nebraska Health Connect: Nebraska Health Connect is a statewide initiative dedicated to helping residents understand their health insurance options and access affordable coverage. Through enrollment assistance, education, and referrals to local resources, Nebraska Health Connect empowers individuals and families to navigate the healthcare system effectively. Residents can reach out to Nebraska Health Connect for personalized assistance with enrollment and accessing healthcare services.

- Online Platforms: Online platforms such as HealthSherpa offer Nebraska residents a convenient way to compare health insurance plans, estimate costs, and enroll in coverage. These platforms provide user-friendly tools and resources to help individuals make informed decisions about their health insurance options. By accessing online marketplaces, residents can explore available plans from multiple insurance carriers, compare coverage options, and apply for coverage online.

By utilizing these additional resources, Nebraska residents can gain the support and information they need to understand how to get health insurance in Nebraska, navigate the enrollment process, and access essential healthcare services. Whether seeking guidance on understanding insurance policies, resolving disputes, or finding affordable coverage options, these resources are valuable assets for individuals and families across the state.

Conclusion: How to get Health Insurance in Nebraska with Confidence

Understanding how to get health insurance in Nebraska is vital for ensuring access to quality healthcare coverage and services. By exploring the various health insurance options available, including Nebraska’s Health Insurance Marketplace, Medicaid, CHIP, Medicare, employer-sponsored insurance, and private health insurance plans, individuals and families can find coverage tailored to their specific needs and circumstances. Leveraging additional resources such as the Nebraska Department of Insurance, community health centers, legal aid services, patient advocacy organizations, online platforms, and local assistance programs can provide invaluable support throughout the enrollment process.

Now individuals and families can ensure they have the coverage they need to protect their health and financial well-being. In doing so, they can approach the task of obtaining health insurance in Nebraska with confidence, knowing they have the support they need to secure comprehensive coverage.