Navigating the complexities of healthcare can be daunting, but understanding how to get health insurance in Minnesota is a crucial first step for residents aiming to secure their health and financial well-being. Minnesota offers a diverse range of health insurance options, tailored to meet the needs of its residents. From government-sponsored programs like Medical Assistance and MinnesotaCare to private health insurance plans and employer-sponsored insurance, there are avenues available for all individuals and families to find the coverage that best suits their medical needs and budget constraints.

This guide will explore the essentials of health insurance in Minnesota, including key terms, coverage options, and the steps to take in securing health insurance. By equipping yourself with the necessary knowledge, you can confidently navigate the health insurance landscape in Minnesota, ensuring you and your family have access to the healthcare services you need.

Table of Contents

Understanding Health Insurance in Minnesota

Understanding how to get health insurance in Minnesota is essential for residents to ensure they have access to the healthcare coverage they need. Health insurance plays a vital role in managing healthcare costs and accessing medical services, including doctor visits, hospital stays, prescription medications, and preventive care. In Minnesota, individuals and families have several options available for obtaining health insurance, each with its own eligibility requirements, benefits, and enrollment processes. By understanding the basics of health insurance, including key terminology, coverage options, and eligibility criteria, individuals can make informed decisions about their healthcare coverage needs.

When exploring how to get health insurance in Minnesota, it’s important to be aware of the different types of coverage available. These include employer-sponsored insurance, private health insurance plans, government-sponsored programs such as Medicaid and Medicare, and Minnesota’s Health Insurance Marketplace, MNsure. Each option has its own advantages and considerations, and individuals need to assess their eligibility and preferences to choose the most suitable option for their healthcare needs. Additionally, understanding the associated costs of health insurance, such as premiums, deductibles, copayments, and coinsurance, is crucial for budgeting and managing healthcare expenses effectively.

Navigating the healthcare system in Minnesota can be complex, but with a solid understanding of health insurance fundamentals, residents can confidently pursue the coverage they need. By exploring the various options available, including MNsure, Medical Assistance, MinnesotaCare, Medicare, employer-sponsored insurance, and private health insurance plans, individuals can find the right fit for their healthcare needs. With knowledge of available resources and options, obtaining health insurance in Minnesota becomes a more straightforward process, providing individuals and families with the assurance and security of access to quality healthcare services.

Exploring Your Health Insurance Options in Minnesota

When it comes to securing health insurance in Minnesota, residents have a variety of options to consider. Understanding these options is essential for finding the coverage that best suits individual and family needs. Minnesota’s diverse healthcare landscape offers a range of avenues, including employer-sponsored plans, government programs like Medicaid and Medicare, the states health insurance marketplace, and private health insurance providers. Below we will discuss all the potential health insurance options in Minnesota.

MNsure: Minnesota’s Health Insurance Marketplace

MNsure serves as the dedicated Health Insurance Marketplace for residents of Minnesota, offering a convenient and comprehensive platform for securing health insurance coverage. Through MNsure, individuals and families can explore a wide range of insurance plans from reputable private insurers operating in the state. This marketplace provides a user-friendly interface where users can compare different plans based on their specific needs, including coverage options, premiums, deductibles, and provider networks.

One of the key advantages of MNsure is its accessibility and affordability. The platform facilitates enrollment in various financial assistance programs, such as premium tax credits and cost-sharing reductions, which help eligible individuals and families reduce the overall cost of health insurance premiums and out-of-pocket expenses. MNsure also offers personalized assistance from trained navigators who can guide users through the enrollment process, answer questions, and provide support in choosing the right plan for their circumstances.

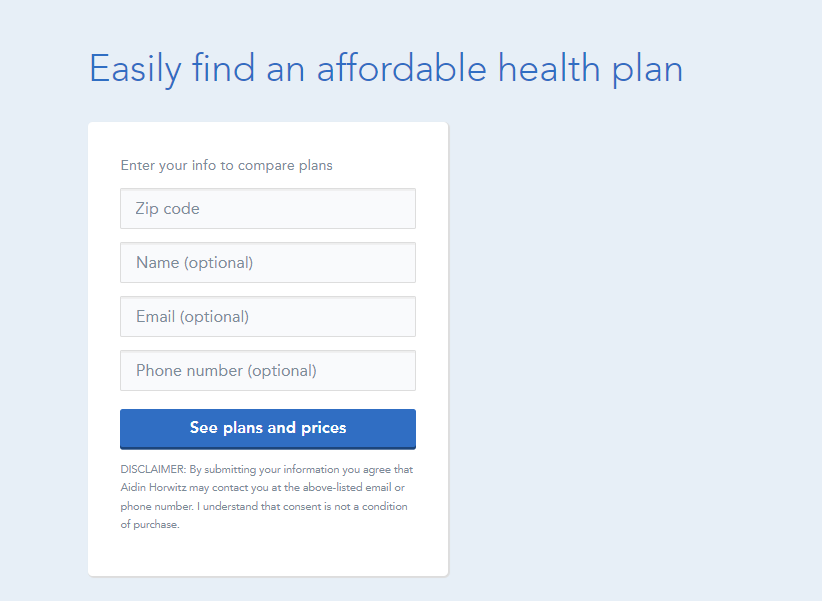

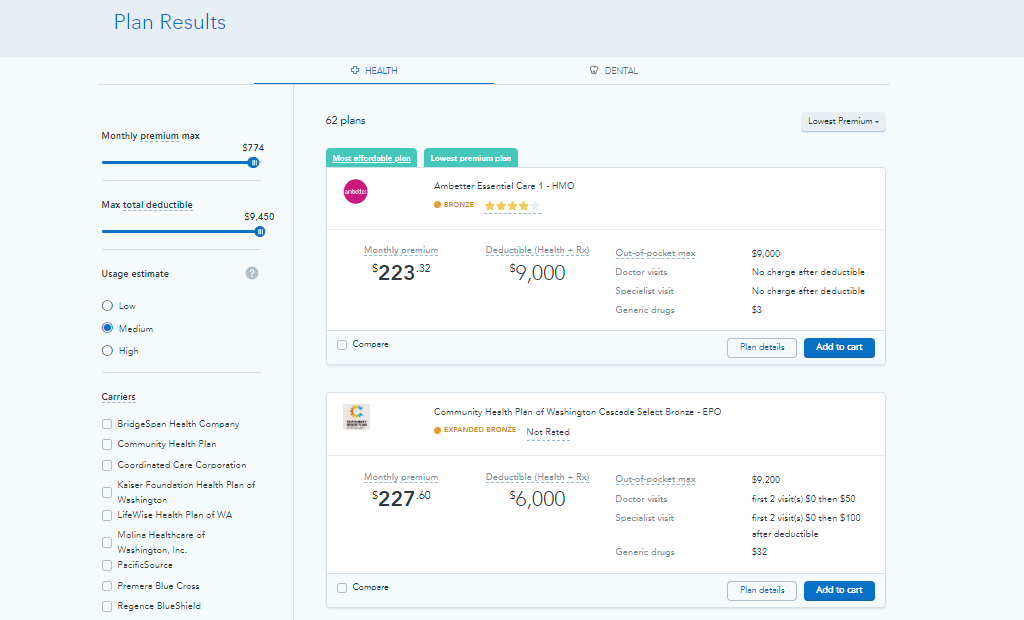

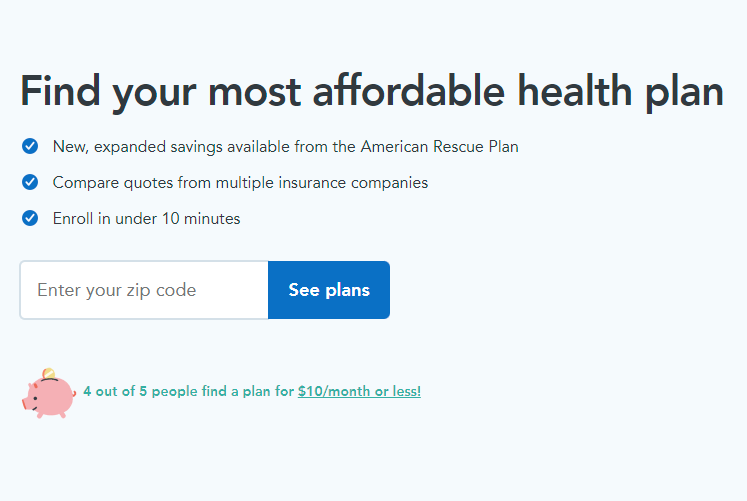

For those seeking an additional resource to apply for health insurance plans, online comparison tools offer a convenient solution. HealthSherpa provides an easy-to-use online platform where users can quickly compare different plans available through MNsure, receive personalized recommendations, and complete the application process with ease.

Medical Assistance (Medicaid in Minnesota)

Medical Assistance, commonly known as Medicaid, plays a vital role in providing healthcare coverage to eligible low-income individuals and families in Minnesota. Administered by the Minnesota Department of Human Services (DHS), Medical Assistance offers comprehensive benefits, including doctor visits, hospital care, prescription medications, preventive services, and more. This program serves as a lifeline for those who may otherwise struggle to afford essential healthcare services.

Eligibility for Medical Assistance is primarily based on income and household size, with certain categories of individuals, such as pregnant women, children, seniors, and individuals with disabilities, qualifying for coverage. The application process for Medical Assistance is straightforward, with individuals able to apply online through MNsure or by contacting their local county human services agency. Once approved, beneficiaries gain access to a wide range of medical services provided by a network of healthcare providers across the state, ensuring they receive the care they need to maintain their health and well-being.

For those who meet the eligibility criteria, enrolling in Medical Assistance can provide invaluable financial protection against the high costs of healthcare. By accessing this program, individuals and families can receive the medical care they require without facing significant financial barriers. Additionally, Medical Assistance plays a crucial role in promoting health equity by ensuring that all Minnesotans have access to quality healthcare services, regardless of their income level or socioeconomic status.

MinnesotaCare

MinnesotaCare, a state-sponsored healthcare program, offers affordable health insurance coverage to low-income residents of Minnesota who do not qualify for Medical Assistance (Medicaid) but cannot afford private health insurance. Administered by the Minnesota Department of Human Services (DHS), MinnesotaCare provides comprehensive benefits, including doctor visits, hospital care, prescription medications, preventive services, and more, at a reduced cost.

Eligibility for MinnesotaCare is based on income and household size, with individuals and families meeting specific income guidelines qualifying for coverage. The program offers sliding-scale premiums based on income, ensuring that enrollees pay affordable monthly premiums based on their financial situation. Moreover, MinnesotaCare provides coverage for essential healthcare services through a network of participating healthcare providers across the state, ensuring access to quality medical care for enrollees.

Applying for MinnesotaCare is a straightforward process, with individuals able to apply online through MNsure, the state’s health insurance marketplace, or by submitting a paper application to the Minnesota Department of Human Services. Once enrolled, beneficiaries gain access to comprehensive healthcare coverage, providing them with peace of mind knowing that their medical needs are covered. MinnesotaCare plays a critical role in ensuring that all Minnesotans have access to affordable healthcare, promoting better health outcomes and financial stability for individuals and families across the state.

Medicare in Minnesota

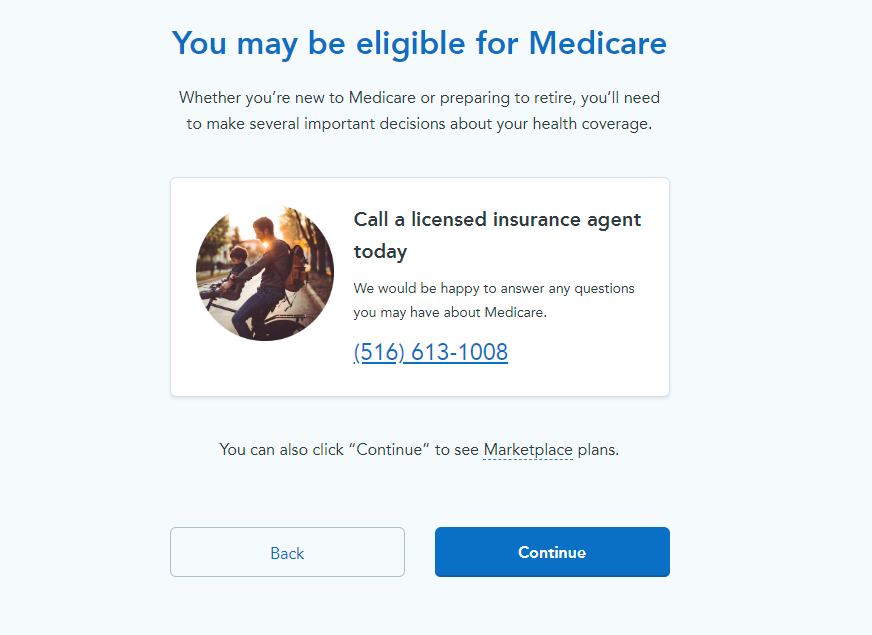

Medicare, a federal health insurance program, provides coverage to eligible individuals aged 65 and older, as well as younger individuals with certain disabilities or qualifying medical conditions in Minnesota. Administered by the Centers for Medicare & Medicaid Services (CMS), Medicare in Minnesota offers various coverage options to meet the diverse healthcare needs of its residents.

Original Medicare, consisting of Part A (hospital insurance) and Part B (medical insurance), forms the foundation of Medicare coverage in Minnesota. Part A helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services, while Part B covers doctor visits, outpatient services, preventive care, and durable medical equipment.

In addition to Original Medicare, Medicare beneficiaries in Minnesota have the option to enroll in Medicare Advantage plans (Part C) offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare and may include additional benefits such as prescription drug coverage (Part D), vision, dental, and wellness programs. With a range of Medicare options available, residents of Minnesota can select the plan that best meets their healthcare needs and budgetary preferences. Click on the link below to see if you qualify or call (833) 703-2758 to speak directly with a Medicare specialist.

Or Call (833) 703-2758

Employer-Sponsored Insurance in Minnesota

Employer-sponsored insurance (ESI) stands as a significant avenue for obtaining health coverage in Minnesota, often provided by employers as part of their benefits package. This option offers individuals and families access to comprehensive healthcare coverage through their employer, typically at a group rate, which can result in cost savings compared to individual plans.

To acquire employer-sponsored insurance in Minnesota, individuals usually need to be employed by a company that offers health benefits. Eligibility criteria and enrollment processes vary by employer, so it’s essential to familiarize yourself with your employer’s specific policies and deadlines for enrolling in health insurance. Typically, employers provide information about health insurance options during the onboarding process or through annual benefits enrollment periods. If you’re unsure about your eligibility or how to enroll, don’t hesitate to reach out to your employer’s human resources department.

Moreover, employer-sponsored insurance often offers a range of coverage options, including different plan types (such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or High-Deductible Health Plan (HDHP)), various levels of coverage (such as individual, employee-plus-one, or family coverage), and additional benefits like dental, vision, or wellness programs. When considering employer-sponsored insurance, carefully review the plan details, including premiums, deductibles, copayments, and network coverage, to ensure the plan aligns with your healthcare needs and financial situation. By leveraging employer-sponsored insurance, individuals in Minnesota can access comprehensive coverage with the support of their employer, providing peace of mind and financial protection against healthcare expenses.

Private Health Insurance Plans

Private health insurance plans offer individuals in Minnesota the opportunity to customize their healthcare coverage according to their specific needs and preferences. These plans are typically purchased directly from insurance companies or through insurance brokers, providing flexibility and choice in coverage options.

When exploring private health insurance plans in Minnesota, individuals have a variety of options to consider, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and High-Deductible Health Plans (HDHPs). Each plan type has its own features and benefits, so it’s essential to evaluate them carefully to determine which best suits your needs.

Additionally, private health insurance plans often provide coverage for a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, preventive care, and more. Some plans may also offer additional benefits such as dental, vision, and alternative therapies. By comparing different private health insurance plans and assessing their features, coverage options, and costs, individuals can find the plan that best meets their healthcare needs and budget.

Moreover, private health insurance plans in Minnesota may also offer access to a broader network of healthcare providers, allowing individuals to choose their preferred doctors, specialists, and hospitals. This can be particularly beneficial for those who have specific healthcare providers they wish to continue seeing. Overall, private health insurance plans provide individuals with greater control over their healthcare and offer comprehensive coverage options tailored to their needs.

To obtain private health insurance in Minnesota, individuals can explore different options available through insurance carriers websites, brokers, or online marketplaces. Comparing plans from multiple providers allows consumers to evaluate premiums, deductibles, copayments, and coverage benefits to find the most suitable plan for their needs. Additionally, some online platforms, like HealthSherpa, streamline the process of comparing and applying for health insurance by providing easy-to-use tools and resources. By utilizing these platforms, Minnesota residents can navigate the complexities of the insurance market and select a plan that meets their healthcare needs and budget constraints.

Choosing the Right Health Insurance Plan

When selecting the right health insurance plan in Minnesota, it’s essential to consider various factors to ensure you find coverage that meets your needs and budget. Here are some key steps to help you navigate the process:

- Assess Your Healthcare Needs: Start by evaluating your healthcare needs and those of your family members. Consider factors such as frequency of doctor visits, prescription medication requirements, anticipated medical procedures, and any chronic health conditions. Understanding your healthcare needs will guide you in choosing a plan that provides the necessary coverage.

- Explore Available Options: Research the different health insurance plans available in Minnesota, including those offered through MNsure, Medicaid, MinnesotaCare, employer-sponsored insurance, and private insurers. Each type of plan has its own features, benefits, and eligibility criteria, so it’s important to explore all your options.

- Understand Plan Features: Take the time to understand the features of each health insurance plan, including coverage limits, deductibles, copayments, coinsurance, and out-of-pocket maximums. Pay attention to whether the plan covers essential services such as doctor visits, hospital stays, prescription drugs, and preventive care.

- Consider Costs: Compare the costs associated with each health insurance plan, including monthly premiums, deductibles, copayments, and coinsurance. While plans with lower premiums may seem more affordable upfront, they may have higher out-of-pocket costs when you receive medical care. Be sure to choose a plan that balances affordability with comprehensive coverage.

- Review Provider Networks: Check the provider networks associated with each health insurance plan to ensure your preferred doctors, specialists, and hospitals are included. In-network providers typically offer lower costs for covered services, so it’s important to confirm that your healthcare providers participate in the plan.

- Seek Assistance if Needed: If you’re unsure about which health insurance plan is right for you, consider seeking assistance from a licensed insurance agent, healthcare navigator, or enrollment counselor. These professionals can provide personalized guidance and help you understand your options.

By following these steps and carefully evaluating your options, you can choose the right health insurance plan in Minnesota that provides the coverage you need to protect your health and financial well-being. Remember to regularly review your coverage and make adjustments as needed to ensure you have adequate protection for your healthcare needs.

Additional Resources for Minnesota Residents

In addition to the various health insurance options available in Minnesota, residents can access a range of additional resources to help them navigate the process of obtaining coverage. These resources provide valuable assistance and information to individuals seeking to understand their healthcare options and find the right insurance plan for their needs.

- MNsure Assistance: MNsure, Minnesota’s health insurance marketplace, offers assistance to individuals and families seeking coverage. Through MNsure, residents can access trained navigators and enrollment counselors who provide free, personalized assistance with understanding plan options, determining eligibility for financial assistance, and completing the enrollment process.

- Government Assistance Programs: Minnesota offers various government assistance programs to help eligible individuals and families access healthcare coverage. Programs like Medical Assistance (Medicaid) and MinnesotaCare provide low-cost or free health insurance to qualified residents, offering essential financial support to those in need.

- Online Tools and Resources: Residents can utilize online tools and resources to compare health insurance plans, estimate costs, and determine eligibility for financial assistance. Websites like MNsure and HealthSherpa provide user-friendly platforms where individuals can explore their options, compare plans side by side, and complete the enrollment process online.

By utilizing these additional resources, Minnesota residents can gain valuable support and guidance as they navigate the process of obtaining health insurance coverage. Whether seeking assistance from trained professionals, accessing affordable healthcare services, or utilizing online tools, these resources can help individuals make informed decisions and find the coverage they need to protect their health and well-being.

Conclusion: How to get Health Insurance in Minnesota with Confidence

Understanding how to get health insurance in Minnesota is crucial for ensuring that residents can navigate the healthcare system with confidence and access the necessary coverage for their medical needs. The state offers a variety of health insurance options, including MNsure, Medical Assistance, MinnesotaCare, Medicare, employer-sponsored insurance, and private health insurance plans. Each of these options caters to different needs and financial situations, providing Minnesotans with the flexibility to choose a plan that best suits their healthcare requirements.

To get health insurance in Minnesota with confidence, it’s essential to thoroughly research and compare the available options, understand the associated costs, and assess your healthcare needs. By taking advantage of resources like MNsure’s navigators and enrollment counselors, community health centers, and nonprofit organizations, residents can receive guidance and support throughout the enrollment process. Additionally, utilizing online tools and resources can simplify the comparison and application process, making it easier to find a suitable health insurance plan.

For Minnesotans, having the right health insurance means not just financial protection against unexpected medical expenses but also access to necessary healthcare services that ensure long-term health and well-being. By making informed decisions and understanding how to get health insurance in Minnesota, residents can secure the coverage they need to confidently manage their health care.

Remember, the journey to obtaining health insurance may seem complex, but with the right information and resources, it’s possible to navigate the system successfully. Whether you’re looking for comprehensive coverage, need assistance with medical expenses, or seeking preventive care, there’s a health insurance option in Minnesota that can meet your needs.