Understanding how to get health insurance in Massachusetts is the first step toward ensuring you and your family have access to the healthcare services you need. This guide aims to provide Massachusetts residents with a clear and comprehensive overview of the health insurance landscape in the state. From navigating the Massachusetts Health Connector to exploring options like MassHealth, Medicare, and private insurance plans, we’ll cover the essential information you need to make informed decisions about your healthcare coverage. Let’s dive into the details to help you understand your options and confidently choose the best health insurance plan for your unique needs.

Table of Contents

Understanding Health Insurance in Massachusetts

To navigate the process of obtaining health insurance in Massachusetts effectively, it’s vital to comprehend the intricacies of the state’s healthcare system. Massachusetts is renowned for its commitment to universal healthcare access, with various initiatives and programs in place to ensure residents have access to affordable coverage.

In Massachusetts, health insurance plans typically cover a wide range of essential services, including doctor visits, hospital stays, preventive care, prescription drugs, and more. This coverage ensures that individuals and families can access the healthcare services they need without incurring significant out-of-pocket expenses. Moreover, the state’s individual mandate underscores the importance of having health insurance, with penalties for residents who do not maintain coverage. Therefore, understanding the nuances of health insurance options available in Massachusetts is crucial for compliance with state regulations and safeguarding one’s health and financial well-being.

Whether you’re exploring employer-sponsored insurance, private health insurance plans, or government programs like MassHealth and Medicare, having a comprehensive understanding of health insurance in Massachusetts is paramount. By familiarizing yourself with available plans, eligibility requirements, and enrollment procedures, you can make informed decisions to select the best coverage for your unique needs. With the right knowledge and resources at your disposal, you can navigate the Massachusetts healthcare landscape with confidence, ensuring that you and your loved ones have access to quality healthcare coverage when it matters most.

Exploring Your Health Insurance Options in Massachusetts

When it comes to health insurance in Massachusetts, residents have a variety of options to consider. Understanding these options is key to finding coverage that meets your needs and fits your budget. Below we will discuss all the potential health insurance options.

Massachusetts Health Connector: The State Marketplace

The Massachusetts Health Connector stands as the central hub for residents to access health insurance options tailored to their needs. Serving as the state’s marketplace, it offers a comprehensive array of plans from various private insurance companies, enabling individuals and families to find coverage that aligns with their requirements. Through its intuitive platform, users can easily compare plans based on factors like coverage benefits, premiums, deductibles, and provider networks, empowering them to make informed decisions about their healthcare.

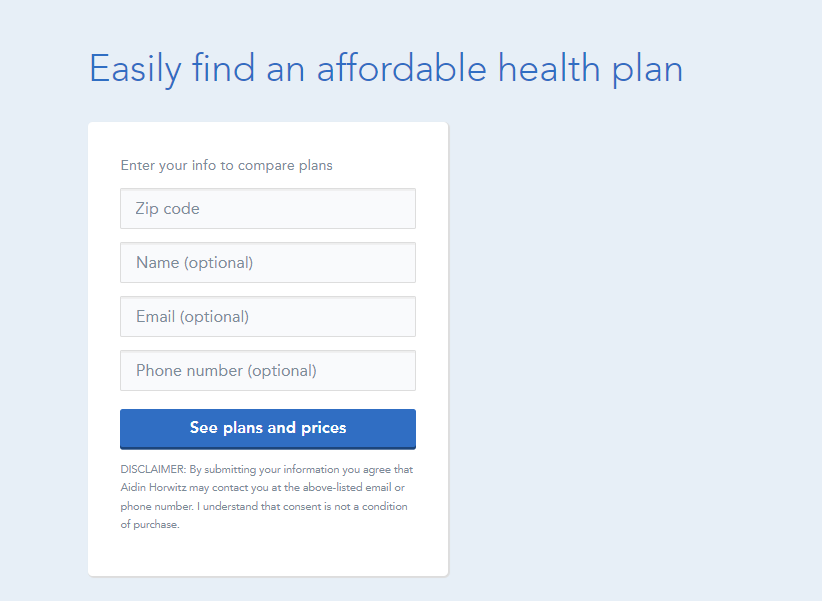

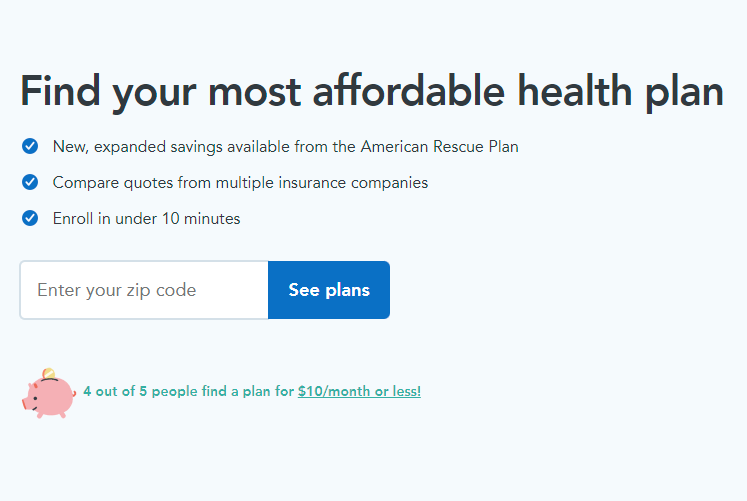

Moreover, the Massachusetts Health Connector provides extensive resources and support to guide consumers through the enrollment process. Whether online, over the phone, or in-person at designated enrollment centers, individuals can receive personalized assistance from trained professionals. These resources help simplify the complexities of health insurance, ensuring that residents understand their options and can navigate enrollment confidently. For further assistance and convenience, platforms like HealthSherpa offer additional tools and support to streamline the process of comparing plans, accessing financial aid, and enrolling in coverage, making it easier for Massachusetts residents to secure the health insurance they need.

MassHealth (Medicaid in Massachusetts)

MassHealth, Massachusetts’ Medicaid program, is pivotal in providing access to essential healthcare services for eligible individuals and families. Administered by the state’s Medicaid agency, it offers comprehensive coverage for various medical needs, including doctor visits, hospital stays, prescription medications, preventive care, mental health services, substance abuse treatment, and more. This program serves as a lifeline for low-income residents, ensuring financial protection against the exorbitant costs of medical care while guaranteeing access to necessary health services.

Eligibility for MassHealth primarily hinges on income and household size. It caters to low-income individuals, families, pregnant women, children, seniors, and individuals with disabilities. Thanks to expansions under the Affordable Care Act (ACA), more low-income adults can now access healthcare services through MassHealth. Applying for MassHealth is straightforward, with options including online applications, phone enrollment, in-person assistance at community organizations, and mail-in forms. Once enrolled, individuals gain access to a network of healthcare providers who accept MassHealth coverage, ensuring uninterrupted access to the care they need.

MassHealth serves as a critical safety net for Massachusetts residents, bridging gaps in access to healthcare and mitigating disparities in health outcomes. By providing comprehensive benefits and financial assistance, the program contributes to improving health equity across the state. For those eligible, MassHealth offers not just medical coverage but also peace of mind and financial stability, ensuring that essential healthcare services remain within reach for all.

Medicare in Massachusetts

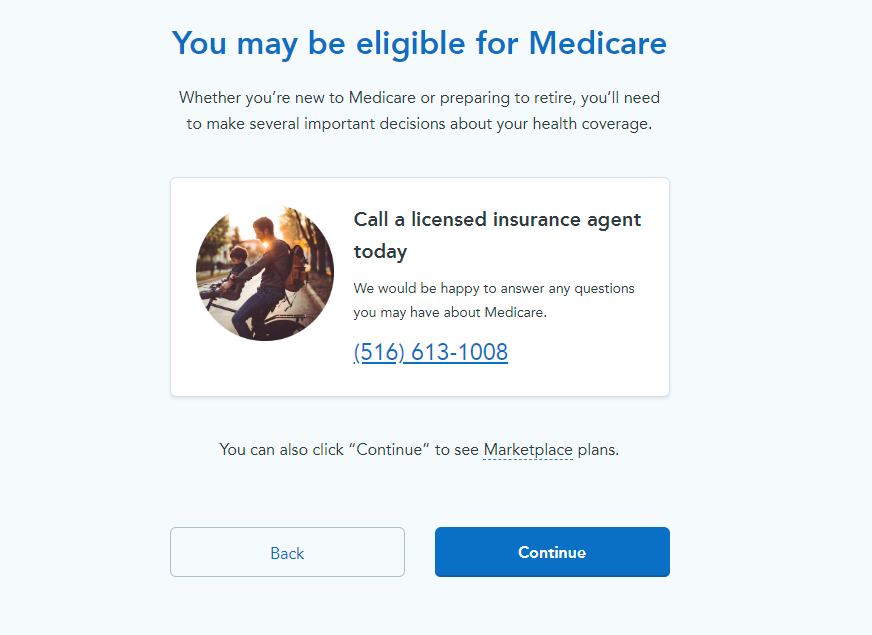

Medicare serves as a vital federal health insurance program for individuals aged 65 and over, and certain younger people with disabilities or specific medical conditions in Massachusetts. It offers various coverage parts, with Original Medicare encompassing Part A (hospital insurance) and Part B (medical insurance). This coverage extends to hospital stays, doctor visits, outpatient care, preventive services, and some home health services, ensuring beneficiaries have access to essential healthcare.

Medicare Advantage plans (Part C), provided by private insurers, include all the benefits of Original Medicare plus additional coverages like prescription drugs (Part D), vision, dental, and wellness programs. These plans vary in networks, premiums, and cost-sharing details, giving beneficiaries the flexibility to select a plan that aligns with their healthcare needs and financial situation.

For prescription medication coverage, Medicare Prescription Drug Plans (Part D) are available as standalone plans from private companies. These plans are accessible to all Medicare beneficiaries, offering a way to manage prescription drug costs and secure access to necessary medications. Additionally, Medicare Supplement Insurance (Medigap) in Massachusetts helps fill coverage gaps in Original Medicare, covering costs like deductibles, coinsurance, and copayments, providing extra financial security and reducing out-of-pocket healthcare expenses.

Overall, Medicare’s comprehensive coverage options ensure Massachusetts’s eligible residents can obtain the healthcare services they need. Whether through Original Medicare, Medicare Advantage, Prescription Drug Plans, or Medigap, Medicare aims to support the health and well-being of its beneficiaries by offering a range of plans to meet diverse healthcare requirements and financial capacities. Click on the link below to see if you qualify or call (833) 703-2758 to speak directly with a Medicare specialist.

Or Call (833) 703-2758

Employer-Sponsored Insurance in Massachusetts

Employer-sponsored insurance (ESI) plays a significant role in providing healthcare coverage to residents of Massachusetts, with many employers offering it as part of their benefits package. These plans often boast comprehensive coverage and competitive premiums, making them an attractive option for individuals and families. In Massachusetts, ESI typically encompasses a range of benefits, including medical, dental, and vision coverage, alongside additional perks like wellness programs and flexible spending accounts (FSAs).

Moreover, ESI plans usually leverage group purchasing power, allowing employees to access healthcare services at lower costs compared to individual plans. They also offer the advantage of a broader network of healthcare providers, ensuring ample choices for medical care and specialists. While ESI is a valuable option for many, it’s essential for employees to carefully review plan details, including premiums, deductibles, and copayments, to select the most suitable coverage for their needs and budget. Additionally, individuals should consider factors such as network adequacy and prescription drug coverage to ensure comprehensive healthcare access through their employer-sponsored insurance plan.

To obtain ESI in Massachusetts, individuals usually need to be employed by a company that offers health insurance benefits. During designated enrollment periods or upon starting a new job, employees have the opportunity to enroll in ESI plans or adjust their existing coverage. Employers may furnish informational sessions or materials to assist employees in understanding their health insurance options and making informed decisions. By leveraging ESI offerings, Massachusetts residents can secure comprehensive health coverage for themselves and their families while benefiting from employer-sponsored benefits.

Private Health Insurance Plans

Private health insurance plans offer individuals in Massachusetts the opportunity to customize their healthcare coverage according to their specific needs and preferences. These plans, available through private insurance companies, cater to diverse healthcare requirements, providing flexibility and choice to policyholders.

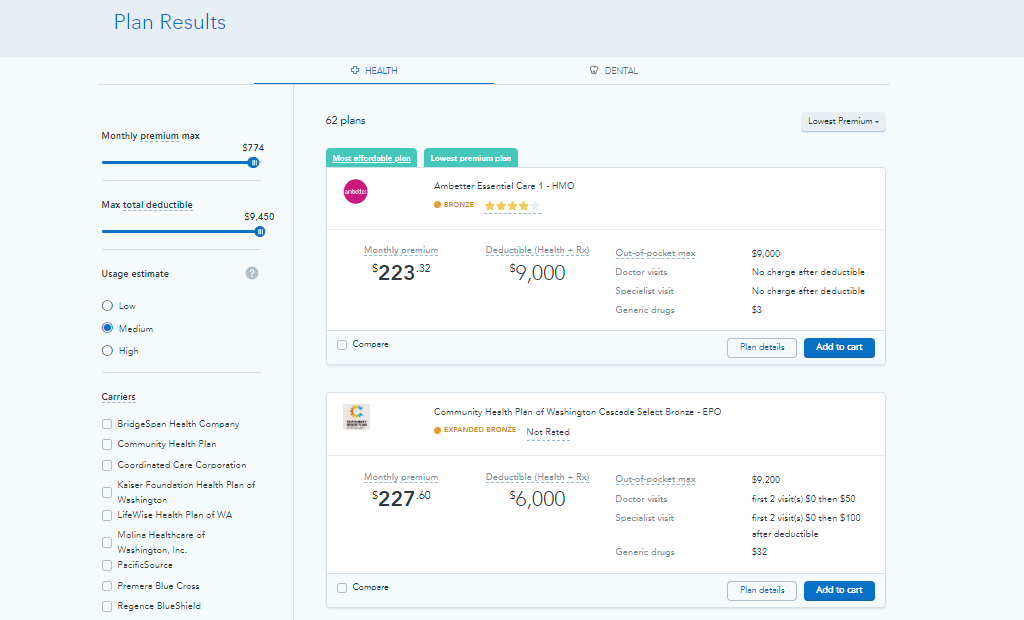

These plans come in different types, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Exclusive Provider Organization (EPO) plans. Each plan type offers distinct features and benefits, allowing individuals to select the one that best aligns with their healthcare needs and budget. With private health insurance, policyholders have the freedom to choose their preferred healthcare providers, including doctors, specialists, and hospitals, ensuring personalized care and access to quality medical services.

Moreover, private health insurance plans in Massachusetts often include additional benefits such as prescription drug coverage, mental health services, maternity care, and preventive care. Policyholders can also benefit from innovative features like telehealth services, which offer convenient access to healthcare professionals from the comfort of their homes. By comparing different private health insurance plans and assessing their coverage options, premiums, and network adequacy, individuals can make informed decisions about their healthcare coverage.

To obtain private health insurance in Massachusetts, individuals can explore different options available through insurance carriers websites, brokers, or online marketplaces. Comparing plans from multiple providers allows consumers to evaluate premiums, deductibles, copayments, and coverage benefits to find the most suitable plan for their needs. Additionally, some online platforms, like HealthSherpa, streamline the process of comparing and applying for health insurance by providing easy-to-use tools and resources. By utilizing these platforms, Massachusetts residents can navigate the complexities of the insurance market and select a plan that meets their healthcare needs and budget constraints.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan in Massachusetts is a critical decision that requires careful consideration of various factors to ensure comprehensive coverage and financial protection. Individuals can navigate the selection process effectively by following the below steps.

Firstly, assess your healthcare needs and those of your family members. Consider factors such as the frequency of doctor visits, prescription medication requirements, anticipated medical procedures, and any existing health conditions. Understanding your healthcare needs will guide you in selecting a plan that provides adequate coverage for your specific requirements.

Next, evaluate the different types of health insurance plans available, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and High-Deductible Health Plans (HDHPs). Each plan type offers unique features, such as network restrictions, cost-sharing structures, and coverage flexibility. Compare the pros and cons of each plan type to determine which aligns best with your preferences and healthcare needs.

Consider the cost implications of each health insurance plan, including monthly premiums, deductibles, copayments, and coinsurance. While plans with lower premiums may seem attractive, they often come with higher out-of-pocket costs when you require medical care. Conversely, plans with higher premiums may offer more extensive coverage and lower out-of-pocket expenses. Evaluate your budget and healthcare needs to strike the right balance between affordability and coverage comprehensiveness.

Additionally, review the provider networks associated with each health insurance plan to ensure your preferred doctors, specialists, hospitals, and healthcare facilities are included. Access to in-network providers can help you avoid additional costs associated with out-of-network care and ensure seamless access to medical services when needed.

Lastly, consider any additional benefits or features offered by each health insurance plan, such as prescription drug coverage, mental health services, maternity care, and preventive care benefits. Assess whether these additional benefits align with your healthcare needs and priorities to enhance your overall coverage.

By carefully evaluating your healthcare needs, budget, provider networks, and plan features, you can confidently choose the right health insurance plan in Massachusetts for you and your family. Remember to review your coverage periodically and adjust your plan as needed to ensure it continues to meet your evolving healthcare needs and financial circumstances.

Additional Resources for Massachusetts Residents

Massachusetts residents have access to a myriad of additional resources aimed at supporting them in their quest to obtain health insurance coverage. These resources serve as invaluable tools, offering guidance, assistance, and information tailored to the unique needs of Massachusetts residents.

One prominent resource is the Massachusetts Health Connector, the state’s official health insurance marketplace. Here, residents can explore various health insurance plans, determine eligibility for financial assistance, and enroll in coverage. The Health Connector website provides user-friendly tools and resources to facilitate plan comparison and decision-making, empowering individuals to make informed choices about their healthcare.

Additionally, Massachusetts residents can benefit from the expertise of certified health insurance navigators. These professionals offer personalized assistance throughout the enrollment process, addressing queries and concerns to ensure individuals understand their options and make the best decisions for their health needs and financial circumstances. Community health centers scattered across Massachusetts also play a pivotal role, providing affordable healthcare services and assisting individuals with enrollment, preventive care access, and chronic condition management.

Consumer advocacy organizations like Health Care For All are another valuable resource, offering educational materials, advocacy support, and guidance on accessing health insurance coverage. These organizations champion the rights of Massachusetts residents, ensuring they have the necessary information and resources to navigate the healthcare system effectively. By leveraging these additional resources, Massachusetts residents can navigate the complexities of obtaining health insurance with confidence, knowing they have access to the support and assistance they need.

Conclusion: How to get Health Insurance in Massachusetts with Confidence

Navigating how to get health insurance in Massachusetts with confidence involves understanding the wealth of resources and options available to residents. This comprehensive guide has walked you through the various paths you can take, from exploring state marketplace options through the Massachusetts Health Connector to considering government programs like MassHealth and Medicare. We’ve also highlighted the importance of employer-sponsored insurance and the flexibility of private health insurance plans, offering a broad spectrum of choices to meet your healthcare needs and financial situation.

Choosing the right health insurance plan requires a careful assessment of your personal healthcare needs, understanding the nuances of each plan type, and considering your budget. Massachusetts’ commitment to providing its residents with access to quality healthcare means there are numerous support systems in place, including certified health insurance navigators and consumer advocacy organizations, to guide you through the process.

By taking advantage of these resources and armed with the knowledge of what each type of insurance plan offers, you can make an informed decision that best suits your and your family’s needs. Whether it’s through the Massachusetts Health Connector, MassHealth, Medicare, employer-sponsored plans, or private insurance, the key is to start the process early and utilize the comprehensive support available to you.

Securing health insurance in Massachusetts is a critical step toward safeguarding your health and financial well-being. With the right approach and resources, you can confidently navigate the healthcare landscape in Massachusetts, ensuring you have access to the necessary medical services when you need them the most. Remember, the goal is not just to find any health insurance coverage but to find the right coverage that offers peace of mind and meets your specific healthcare needs.