Navigating how to get health insurance in Maryland is essential for securing comprehensive healthcare coverage. This guide simplifies the process, providing a clear overview of available health insurance options in the state, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Whether you’re seeking health insurance for the first time or looking to update your coverage, this article offers the insights needed to make informed decisions.

We’ll cover the key aspects of choosing the right health insurance plan, such as understanding coverage details, evaluating provider networks, and considering the costs associated with different plans. Our aim is to demystify health insurance in Maryland, guiding you through government-sponsored programs like Medicaid and Medicare, as well as private insurance options through the Maryland Health Connection. This guide will empower Maryland residents to navigate the health insurance landscape confidently, ensuring access to necessary healthcare services while managing costs effectively.

Table of Contents

Understanding Health Insurance in Maryland

In Maryland, understanding how to get health insurance is crucial for ensuring access to quality healthcare coverage. Whether you’re a resident navigating the system for the first time or looking to explore new options, grasping the fundamentals of health insurance in Maryland is essential. From the intricacies of plan types to the nuances of coverage essentials, having a solid understanding empowers individuals to make informed decisions regarding their healthcare needs.

Health insurance in Maryland encompasses various types of plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers distinct features and benefits, catering to different preferences and requirements. Understanding these differences allows individuals to choose a plan that aligns with their healthcare needs and financial capabilities effectively. Additionally, being aware of coverage essentials such as doctor visits, hospital stays, prescription drugs, and preventive care ensures that individuals select a plan that adequately addresses their medical needs.

Provider networks are another crucial aspect of health insurance in Maryland. Most insurance plans operate within specific networks of doctors, hospitals, and healthcare providers. It’s essential for individuals to verify whether their preferred healthcare providers are included in the network to avoid unexpected costs associated with out-of-network care. Moreover, comprehending the various costs associated with health insurance, including premiums, deductibles, copayments, and coinsurance, enables individuals to budget effectively and select a plan that offers the most value for their investment.

By gaining a comprehensive understanding of health insurance in Maryland, individuals can navigate the system with confidence and secure the coverage they need to safeguard their health and well-being. Whether through government-sponsored programs like Medicaid and Medicare, employer-sponsored insurance plans, or private health insurance options, knowing how to get health insurance in Maryland empowers individuals to make informed choices and access the healthcare services they require.

Exploring Your Health Insurance Options in Maryland

When it comes to obtaining health insurance in Maryland, exploring the available options is the first step toward securing adequate coverage for yourself and your family. Maryland offers a variety of avenues through which individuals can access healthcare benefits, each tailored to meet different needs and circumstances. Below we will discuss all the potential health insurance options.

Maryland Health Connection: The State Insurance Marketplace

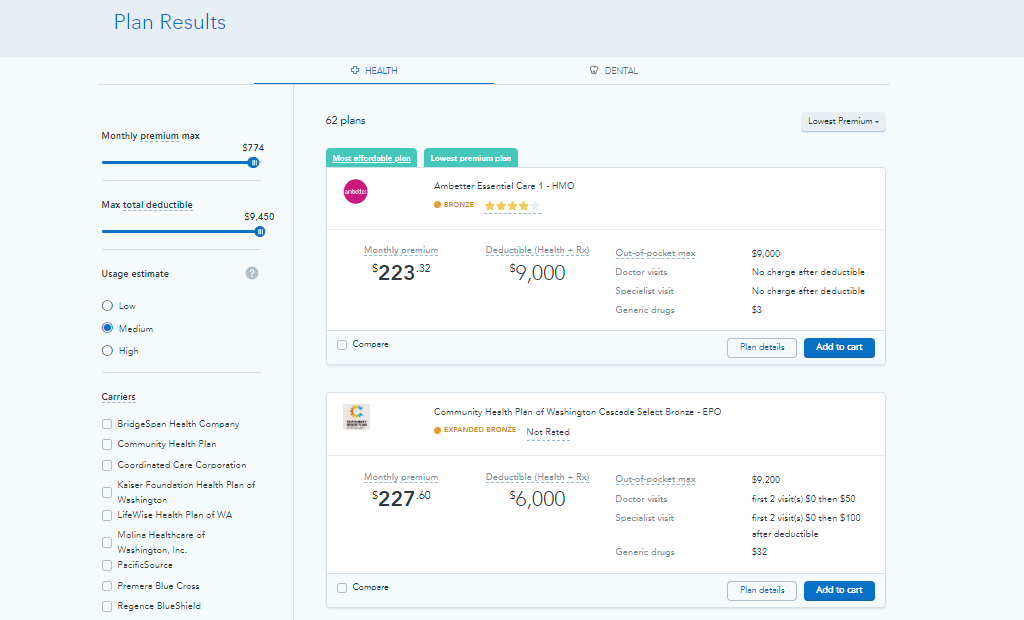

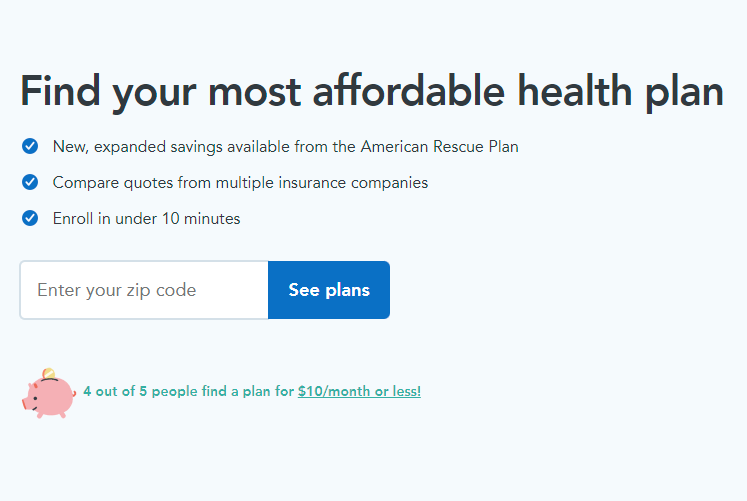

The Maryland Health Connection is the official state insurance marketplace, offering Maryland residents a straightforward platform to explore and purchase health insurance plans. Designed under the Affordable Care Act, this online marketplace provides access to a variety of private insurance options, allowing users to compare coverage levels, premiums, deductibles, and provider networks easily.

Through the Maryland Health Connection, individuals can also determine eligibility for financial assistance programs, including premium tax credits and cost-sharing reductions. These subsidies help make health insurance more affordable for those who qualify.

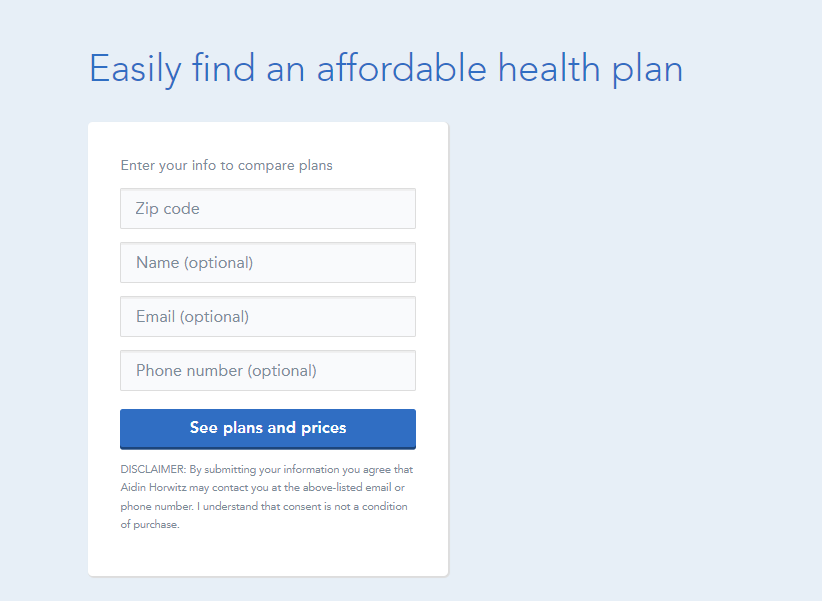

Platforms like HealthSherpa complement the marketplace by offering user-friendly tools to compare plans, estimate costs, and facilitate enrollment with the help of licensed agents, ensuring a smooth process for Maryland residents.

Medicaid in Maryland

Medicaid serves as a vital resource for low-income individuals and families in Maryland, providing comprehensive healthcare coverage to those who meet eligibility criteria. Administered by the Maryland Department of Health, Medicaid offers a wide range of medical services, including doctor visits, hospital stays, prescription medications, preventive care, mental health services, substance abuse treatment, and more.

Eligibility for Medicaid in Maryland is primarily based on income and household size, with coverage available for pregnant women, children, low-income adults, seniors, and individuals with disabilities. The state has expanded its Medicaid program under the Affordable Care Act (ACA), extending coverage to more low-income adults.

Individuals can apply for Medicaid through the Maryland Health Connection, the state’s online insurance marketplace, or directly through the Maryland Department of Health’s Medicaid website. The application process may vary depending on personal circumstances and eligibility criteria. Once enrolled, Medicaid provides essential financial protection against the high costs of medical care and ensures access to necessary health services for eligible individuals and families across Maryland.

Maryland Children’s Health Program (MCHP)

The Maryland Children’s Health Program (MCHP) offers vital healthcare coverage to children and young adults from low-income families who don’t qualify for Medicaid. Administered by the Maryland Department of Health, MCHP provides a wide range of medical services, including doctor visits, hospital stays, prescriptions, preventive care, dental, and vision care.

Eligibility is based on income and household size, extending coverage to children and young adults up to age 19. Families exceeding Medicaid thresholds but within certain income limits may qualify. Enrollment is available through the Maryland Health Connection or directly through the Maryland Department of Health’s website. Once enrolled, MCHP ensures access to essential healthcare, supporting the health and well-being of eligible children and young adults.

Medicare in Maryland

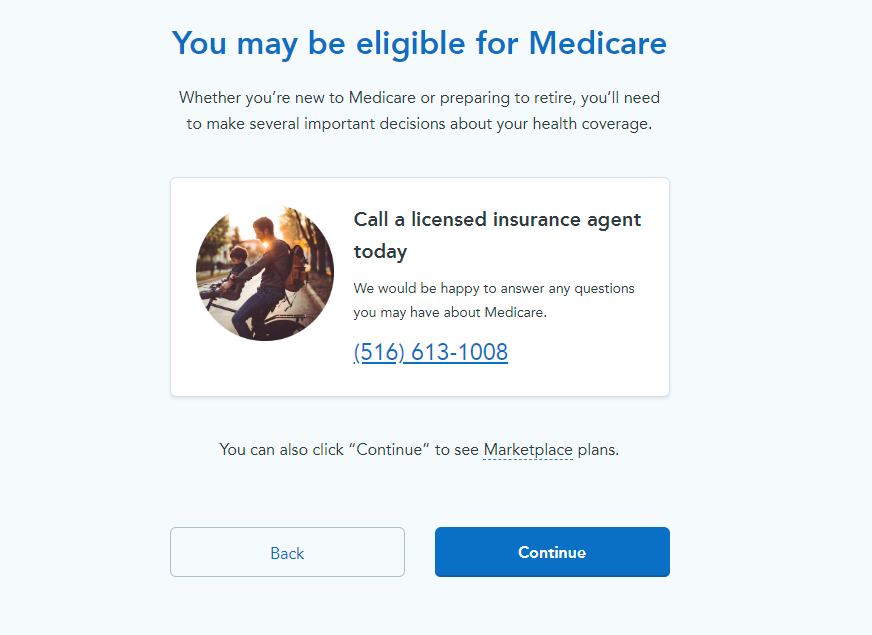

Medicare in Maryland provides essential healthcare coverage to eligible individuals aged 65 and older, as well as younger individuals with qualifying disabilities or specific medical conditions. Administered by the federal government, Medicare offers various coverage options tailored to meet the diverse healthcare needs of Maryland residents.

Original Medicare consists of two parts: Part A, which covers hospital insurance, including inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services, and Part B, which covers medical insurance, including doctor visits, outpatient services, preventive care, and durable medical equipment.

In addition to Original Medicare, Maryland residents have the option to enroll in Medicare Advantage plans (Part C) offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare and often include additional benefits such as prescription drug coverage (Part D), vision, dental, and wellness programs. Medicare Advantage plans offer different networks, premiums, copayments, and coverage options, allowing beneficiaries to choose the plan that best suits their healthcare needs and budget.

Medicare Prescription Drug Plans (Part D) are also available to Maryland residents to provide coverage for prescription medications. These plans are offered by private insurance companies and can be purchased as standalone plans to complement Original Medicare or as part of a Medicare Advantage plan.

Moreover, Medicare Supplement Insurance (Medigap) policies are available to help fill the gaps in coverage left by Original Medicare. These supplemental plans are offered by private insurance companies and can help cover out-of-pocket costs such as deductibles, copayments, and coinsurance, providing beneficiaries with additional financial protection against healthcare expenses.

Maryland residents eligible for Medicare can explore their coverage options and enroll in Medicare plans through the official Medicare website or by contacting Medicare directly. Additionally, individuals can seek assistance from licensed insurance agents or counselors specializing in Medicare to help navigate the enrollment process and find the most suitable coverage for their needs. Click on the link below to see if you qualify or call (833) 703-2758 to speak directly with a Medicare specialist.

Or Call (833) 703-2758

Employer-Sponsored Insurance in Maryland

Employer-sponsored insurance (ESI) in Maryland is a significant avenue for health coverage offered by many employers. These plans vary widely in coverage and cost-sharing structures and often require eligibility based on employment status. By enrolling in ESI, individuals can access benefits such as group purchasing power and extensive networks of healthcare providers, ensuring comprehensive coverage tailored to their needs. Leveraging employer-sponsored insurance can offer Maryland residents cost savings and comprehensive benefits compared to individual plans, providing stability and financial protection against unforeseen health expenses.

If you’re employed, consult your employer to understand your options. If not, Maryland offers alternatives like the Maryland Health Connection, Medicaid, Medicare, and private health insurance plans, ensuring coverage to suit various needs.

Private Health Insurance Plans

These plans, which are accessible via private insurance companies or brokers, offer the flexibility to tailor coverage to individual preferences. Options range from Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, to Exclusive Provider Organization (EPO) plans, allowing individuals to select the type that best fits their healthcare requirements.

To choose the most suitable health insurance, it’s essential to thoroughly evaluate each plan’s coverage details, including premiums, deductibles, copayments, and coinsurance rates. Key considerations should also include the extent of prescription drug coverage, mental health services, maternity care, and preventive care benefits.

By leveraging online comparison tools and consulting with insurance brokers, individuals can simplify the selection process. This approach ensures that they make well-informed decisions that align with their healthcare needs and financial situation, effectively optimizing their health insurance coverage in Maryland.

Choosing the Right Health Insurance Plan

Navigating how to get health insurance in Maryland for 2024 involves a detailed examination of various critical factors to find a plan that aligns with your healthcare needs and financial capacity. Begin by analyzing your healthcare requirements, such as how often you visit doctors, your need for prescription medications, and any expected medical procedures. It’s important to look at the extent of coverage you need, including benefits for prescription drugs, mental health support, and preventive care services.

When comparing health insurance plans, pay close attention to the associated costs, including monthly premiums, deductibles, copayments, and coinsurance. Plans with lower premiums might initially seem cost-effective, but they can lead to higher out-of-pocket expenses when accessing medical care. On the other hand, plans with higher premiums often provide more extensive coverage and reduced out-of-pocket costs, making it crucial to find a balance that works for you.

Make sure to ensure the health insurance plan you’re considering has an adequate provider network that includes your preferred doctors, specialists, and healthcare facilities to avoid extra costs linked to out-of-network care. Plans with extensive provider networks are preferable for ensuring easy access to healthcare services that meet your expectations and needs.

Finally, look into any extra perks or services offered by the plans, such as telehealth options or wellness incentives, which can significantly enhance your healthcare experience. By meticulously evaluating your health needs, financial considerations, provider network preferences, and the additional benefits each plan offers, you can make an informed decision on the right health insurance in Maryland for 2024.

Additional Resources for Maryland Residents

Discovering how to get health insurance in Maryland involves leveraging a variety of resources designed to simplify the process for residents. The state provides platforms such as Maryland Health Connection, where people can effortlessly compare health insurance plans, check for financial aid eligibility, and sign up for the best coverage option.

For those seeking more personalized support, certified healthcare navigators are on hand to offer expert guidance through the enrollment steps, helping individuals make choices that best fit their health needs. Maryland’s community health centers also play a crucial role by offering low-cost healthcare services and support in health insurance enrollment, preventive care access, and chronic condition management.

Groups like Consumers for Affordable Health Care (CAHC) are instrumental in offering insights and tools for understanding and securing health insurance in Maryland. Additionally, various educational events such as workshops and webinars, organized by government bodies, healthcare entities, and community organizations, provide valuable knowledge on navigating health insurance options, obtaining enrollment assistance, and enhancing healthcare affordability.

Conclusion: How to get Health Insurance in Maryland with Confidence

Obtaining health insurance in Maryland is a vital step toward ensuring one’s health and financial security. By understanding the various options available, such as those offered through Maryland Health Connection, Medicaid, Medicare, employer-sponsored plans, and private insurance providers, residents can tailor their choices to meet their specific needs. Utilizing platforms like HealthSherpa and seeking assistance from certified healthcare navigators can streamline the enrollment process, empowering individuals to make informed decisions.

Additionally, tapping into resources provided by community health centers, consumer advocacy organizations like Consumers for Affordable Health Care (CAHC), and educational workshops further equips residents with the knowledge and support needed to navigate the complexities of healthcare coverage. With these resources at their disposal, Maryland residents can confidently secure the health insurance they need, safeguarding their well-being and peace of mind for the future.

Securing Your Health Insurance for 2024

Understanding how to get health insurance in Maryland is crucial for safeguarding your health and financial stability. Begin by assessing your healthcare needs and financial capacity to pinpoint the necessary coverage level. Maryland offers a broad spectrum of health insurance avenues, including employer-sponsored plans, the Health Insurance Marketplace, Medicare, Medicaid, and direct purchases from private insurers, to cater to diverse needs.

Staying proactive and informed about the evolving health insurance landscape in Maryland is key to maintaining coverage that aligns with your needs. Regular consultations with healthcare professionals or tapping into state-specific resources can guide you through the intricacies of health insurance with ease. Investing time and effort now not only secures your health and financial well-being but also paves the way for a more secure future.