Understanding how to get life insurance in 2024 is essential for anyone aiming to safeguard their family’s financial well-being. This guide is dedicated to demystifying the process, from evaluating your unique insurance needs to navigating the myriad of policy options available. Whether you’re establishing financial security, protecting your family, or preparing for retirement, our goal is to streamline your journey toward finding the perfect life insurance fit.

In this guide, we delve into key considerations for choosing the right policy, offer insights on comparing different types of life insurance, and provide actionable advice for a smooth application process. Join us as we explore the critical steps to ensure your family’s financial protection with the right life insurance policy in 2024.

Table of Contents

Understanding Life Insurance Needs

When considering life insurance, it’s crucial to evaluate your unique needs to ensure your coverage aligns with your life stage and financial obligations. Start by assessing your current financial situation, including debts, income, and dependents. Consider future financial goals and responsibilities, like children’s education or supporting a partner. Understanding these factors helps you determine the amount of coverage necessary to protect your loved ones financially in case of your untimely passing. This step is foundational in choosing a policy that offers peace of mind and financial security.

Types of Life Insurance Available in 2024

In 2024, consumers have access to a broad range of life insurance products designed to cater to different financial goals and protection needs. The primary types include:

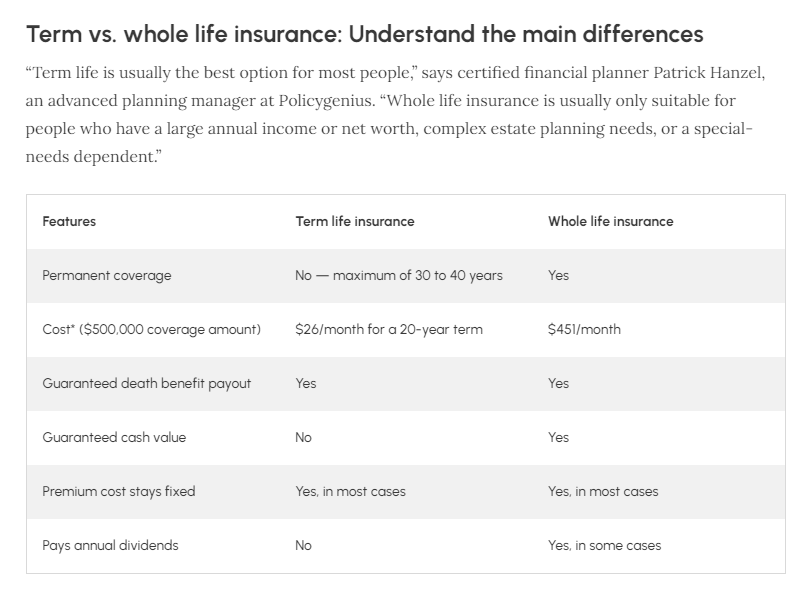

- Term Life Insurance: Offers coverage for a specific period, providing a death benefit if the insured passes away within the term. It’s ideal for those seeking affordable, straightforward protection.

- Whole Life Insurance: Provides lifelong coverage with the added benefit of a cash value component that grows over time. This type is suited for individuals looking for a combination of protection and investment.

- Universal Life Insurance: Offers flexible premiums and coverage amounts, along with a cash value component. It’s designed for those who want adjustable life insurance options.

- Variable Life Insurance: Combines death protection with a savings account that can be invested in various options. Suitable for those comfortable with investment risk in exchange for potential higher returns.

Each type of life insurance serves different needs, from basic coverage to complex financial planning strategies. Understanding these options helps in selecting the right policy that aligns with personal and financial goals.

How to Choose the Right Life Insurance Policy

Selecting the optimal life insurance policy requires a strategic approach. Follow these steps to ensure you make the right choice:

- Evaluate Your Needs: Begin by assessing your financial situation, including debts, income, and future expenses. Consider factors like mortgage payments, education costs for dependents, and other financial obligations.

- Understand Policy Types: Familiarize yourself with the different types of life insurance available, such as term, whole, universal, and variable. Understand how each type works and the benefits they offer.

- Determine Coverage Amount: Calculate the amount of coverage needed to adequately protect your loved ones in the event of your passing. Factor in future financial goals, outstanding debts, and living expenses.

- Consider Policy Features: Pay attention to the features of each policy, such as the length of coverage, premium costs, and potential cash value accumulation. Choose the policy that aligns best with your financial goals and risk tolerance.

- Shop Around: Compare quotes from multiple insurance providers to ensure you’re getting the best value for your money. Don’t hesitate to negotiate or ask questions about discounts or additional benefits.

- Seek Professional Guidance: Consult with a financial advisor or insurance agent who can provide personalized advice based on your specific needs and goals. They can help you navigate the complexities of life insurance and make informed decisions.

By following these steps, you can confidently choose the right life insurance policy that provides the necessary protection for your family’s financial future.

Steps to Applying for Life Insurance in 2024

In 2024, comparing life insurance quotes online is a crucial step in securing the right policy for your needs. With numerous insurers offering a variety of policies, leveraging online comparison tools can simplify your search and help you make an informed decision. Here’s how to navigate this process effectively:

Utilize Online Comparison Platforms

Choosing the Right Platform: Start with reputable online comparison sites like Policygenius or Insure.com. These platforms specialize in gathering quotes from multiple insurance companies, allowing you to compare policies side by side based on your specific needs and preferences.

- Policygenius: This platform stands out for its ease of use and comprehensive guide throughout the comparison process. It offers detailed comparisons of policy features, premiums, and insurer ratings.

- Insure.com: Known for providing a broad spectrum of insurance quotes, Insure.com helps you compare life insurance options along with insights into policy benefits and coverage details.

Key Comparison Criteria

When reviewing quotes, it’s essential to look beyond just the premium costs. Consider the following factors to ensure you’re making a comprehensive comparison:

- Coverage Amount: Ensure the policy provides adequate coverage based on your calculated needs.

- Policy Term: For term life insurance, compare the duration of coverage. Permanent life insurance buyers should look at the policy features and cash value growth projections.

- Premium Rates: While important, premium rates should be considered in the context of the coverage and benefits provided.

- Financial Stability of the Insurer: Check ratings from agencies like A.M. Best or Standard & Poor’s to gauge the insurer’s ability to pay future claims.

- Customer Service: Look for customer reviews or ratings to understand the insurer’s service quality.

Tips for Effective Comparison

- Customize Your Quotes: Use filters on comparison websites to tailor the search results according to your personal and financial situation.

- Check for Hidden Costs: Some policies may include additional fees or charges. Ensure you understand all the costs involved before making a decision.

- Consider Future Needs: While your current focus may be on immediate coverage needs, consider how your insurance needs may evolve over time and whether the policy can be adjusted accordingly.

Making the Most of Comparison Sites

- Take Notes: As you compare different policies, keep notes on the pros and cons of each option.

- Contact Customer Support: If you have questions or need clarification on policy details, don’t hesitate to reach out to the comparison site’s customer support.

Life Insurance Medical Exams: What to Expect

Life insurance medical exams are a standard requirement for many policies, involving filling out a health questionnaire detailing medical history and lifestyle, getting measurements like height, weight, blood pressure, and pulse checked, providing blood and urine samples for testing, discussing medical history with the examiner, undergoing a brief physical exam, and possibly additional tests like an EKG depending on age and health. Preparation involves fasting for eight hours, avoiding caffeine and nicotine, and ensuring proper rest. The examiner maintains privacy and confidentiality throughout. The results of the exam are used by the insurer to evaluate eligibility and risk. Understanding this process can help applicants prepare and navigate the path to securing life insurance coverage.

Common Pitfalls to Avoid When Getting Life Insurance

Securing life insurance is a crucial step in safeguarding your family’s financial future, but it’s essential to navigate the process carefully to avoid potential pitfalls. Here are some common mistakes to steer clear of:

Underinsuring: One of the most significant pitfalls is underestimating your coverage needs. It’s essential to assess your financial obligations accurately to ensure your loved ones are adequately protected in the event of your passing.

Overlooking Policy Details: Don’t skim over the fine print. Take the time to thoroughly review the terms and conditions of your policy to understand coverage limits, exclusions, and any additional benefits or riders included.

Failing to Disclose Information: Transparency is key when applying for life insurance. Failing to disclose relevant information, such as pre-existing medical conditions or risky hobbies, can lead to coverage denial or claim disputes down the line.

Choosing the Wrong Policy Type: Each individual’s financial situation is unique, and not all life insurance policies are created equal. Make sure you understand the differences between term, whole, and universal life insurance to select the right type for your needs.

Waiting Too Long to Get Coverage: Life insurance premiums typically increase with age, so delaying the purchase of a policy can result in higher costs down the road. It’s best to secure coverage as early as possible to lock in lower rates.

Relying Solely on Employer-Sponsored Coverage: While employer-sponsored life insurance may provide some level of coverage, it’s often insufficient to meet long-term needs. Consider supplementing with an individual policy to ensure comprehensive protection.

By avoiding these common pitfalls and taking a proactive approach to securing life insurance, you can ensure that you and your loved ones are adequately protected financially, providing peace of mind for the future.

Life Insurance for Different Life Stages

Life insurance needs vary depending on your stage of life, from young adulthood to retirement. Here’s how to navigate life insurance at each stage:

Young Adults (20s and 30s): In this stage, life insurance may not be a top priority, but it’s an excellent time to lock in lower premiums. Consider term life insurance to cover debts like student loans or mortgage payments and provide financial protection for your family.

Established Families (40s and 50s): As responsibilities grow, so do insurance needs. Evaluate your coverage to ensure it aligns with your family’s financial goals, including income replacement, mortgage protection, and college savings for children.

Empty Nesters (60s and beyond): With children grown and financial obligations reduced, life insurance needs may change. Consider whether coverage is still necessary for estate planning, final expenses, or providing for a surviving spouse.

Retirees: Life insurance can still play a role in retirement planning. Policies with cash value accumulation, like whole life or universal life insurance, can provide supplemental income or leave a legacy for heirs.

Key Considerations: Regardless of life stage, regularly review your life insurance coverage to ensure it meets current needs. Major life events like marriage, birth of a child, or career changes may necessitate adjustments to your policy.

By understanding life insurance needs at different life stages and periodically reassessing coverage, you can ensure that you and your loved ones are adequately protected throughout life’s journey.

Conclusion: How to get Life Insurance in 2024 with Confidence

Securing life insurance in 2024 demands a comprehensive approach that begins with a clear understanding of your personal and financial needs and extends through careful comparison of available policies. Whether you’re assessing your life insurance needs, exploring the different types of policies, or applying for coverage, each step is crucial in ensuring you choose the right policy that offers peace of mind and financial security for your loved ones.

The journey through understanding policy types, evaluating your needs, and navigating the application process, including the medical exams, is streamlined by the wealth of online resources available. Platforms like Policygenius and Insure.com have made comparing policies simpler than ever, allowing you to make an informed decision without getting overwhelmed. Yet, the importance of reading the fine print, being transparent in your application, and avoiding common pitfalls cannot be overstated. Each decision you make impacts the level of protection your policy provides.

Moreover, recognizing that life insurance needs evolve over time is key. Whether you’re a young adult just starting out, part of an established family, an empty nester, or a retiree, revisiting your life insurance coverage to ensure it aligns with your current life stage is essential. Life’s milestones—marriages, births, and career changes—necessitate adjustments to your coverage to ensure your family’s financial future is well protected.

Ultimately, securing life insurance in 2024 is about more than just mitigating financial risk; it’s about ensuring your loved ones have the support they need during life’s most challenging moments. By taking a proactive, informed approach to selecting life insurance, you can navigate this critical decision with confidence, ensuring that your family’s future is secure no matter what lies ahead.

Additional Resources for How to Get Life Insurance in 2024

Embarking on the journey to secure life insurance in 2024 requires not just careful consideration but also access to reliable information. To help you navigate the complexities of how to get life insurance this year, we’ve compiled a list of essential resources. These tools and platforms are designed to empower you with knowledge, enabling you to make informed decisions about your life insurance needs.

Comparison and Quote Platforms

- Policygenius: Streamlines the comparison process, a must-use for anyone researching how to get life insurance in 2024 by offering quotes from various providers.

- Insure.com: Facilitates informed policy selection with its detailed comparisons and insights into life insurance options available in 2024.

Financial Planning and Advice

- Mint and Personal Capital: Both platforms provide tools and advice on integrating life insurance into your financial plan, essential for anyone looking into how to get life insurance in 2024.

- Certified Financial Planners and Independent Insurance Agents: Consulting with professionals can offer personalized insights, making the process of how to get life insurance tailored to your needs.

By leveraging these comprehensive resources, you’re not just searching for how to get life insurance in 2024; you’re ensuring that the policy you choose aligns perfectly with your financial objectives and provides the necessary security for your loved ones. Remember, the journey to securing the right life insurance is an informed one, and with the right tools and knowledge, you can navigate it confidently.