Understanding how to get health insurance in Mississippi is a critical first step for residents looking to safeguard their health and financial well-being. With a variety of health insurance options available, from government programs like Medicaid and CHIP to private insurance plans and employer-sponsored coverage, navigating the landscape can seem overwhelming.

This comprehensive guide aims to demystify the process, providing you with the knowledge and tools needed to make informed decisions about your healthcare coverage. Whether you’re seeking to understand the intricacies of premiums, deductibles, and copayments, or exploring the different types of health insurance plans available in Mississippi, this guide is designed to help you find the coverage that best suits your needs and circumstances.

Table of Contents

Understanding Health Insurance in Mississippi

Understanding Health Insurance in Mississippi can be a crucial step toward accessing essential healthcare services and protecting oneself from unexpected medical expenses. Health insurance functions as a financial safety net, providing coverage for various healthcare needs, including doctor visits, hospital stays, prescription medications, and preventive care. In Mississippi, obtaining health insurance coverage is essential for individuals and families to ensure they have access to the healthcare services they need to maintain their well-being.

Navigating the complexities of health insurance in Mississippi requires a basic understanding of key concepts and terminology. Health insurance plans typically come with different levels of coverage, including premiums, deductibles, copayments, and coinsurance. Premiums are the monthly payments made to the insurance company to maintain coverage, while deductibles represent the amount individuals must pay out of pocket before their insurance coverage kicks in. Copayments and coinsurance are additional costs paid at the time of service or as a percentage of the total cost of care, respectively. Understanding these terms can help individuals make informed decisions when selecting a health insurance plan that aligns with their healthcare needs and budget.

Moreover, it’s essential to be aware of the various types of health insurance plans available in Mississippi. These may include employer-sponsored insurance, private health insurance plans, Medicaid, and the Children’s Health Insurance Program (CHIP). Each type of plan has its eligibility criteria, benefits, and limitations. By exploring the options available and understanding the differences between them, Mississippi residents can make educated decisions about how to obtain health insurance coverage that meets their specific healthcare needs and financial circumstances.

Exploring Your Health Insurance Options in Mississippi

When it comes to securing health insurance in Mississippi, residents have a variety of options to consider. Understanding these options is essential for finding the coverage that best suits individual and family needs. Mississippi’s diverse healthcare landscape offers a range of avenues, including employer-sponsored plans, government programs like Medicaid and Medicare, the states health insurance marketplace, and private health insurance providers. Below we will discuss all the potential health insurance options in Mississippi.

Mississippi’s Health Insurance Marketplace

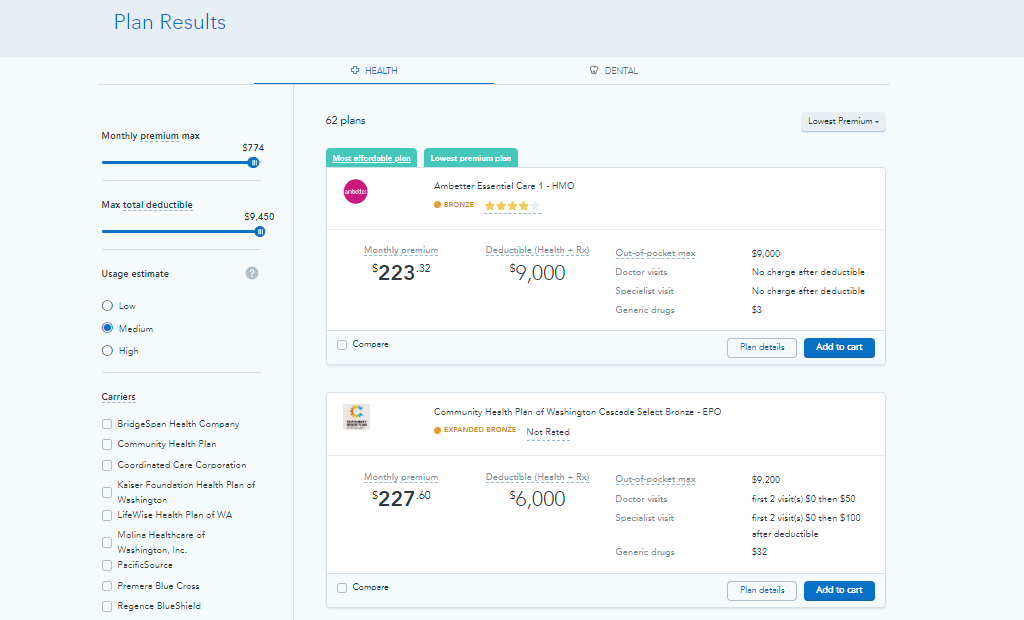

Mississippi’s Health Insurance Marketplace serves as a vital resource for individuals and families seeking accessible and affordable health coverage. Established under the Affordable Care Act (ACA), the Marketplace offers a wide array of health insurance plans from various private insurers. These plans cover essential health benefits, including doctor visits, hospital stays, prescription drugs, preventive care, and mental health services. With options tailored to diverse healthcare needs and budgets, the Marketplace provides a platform for Mississippi residents to explore and compare different plans to find the most suitable coverage.

Financial assistance is available to eligible individuals and families through the Marketplace to help reduce the cost of health insurance premiums. Subsidies such as premium tax credits and cost-sharing reductions can significantly lower out-of-pocket expenses, making health coverage more affordable for those who qualify. Moreover, the Marketplace facilitates an annual open enrollment period, during which individuals can enroll in or change their health insurance plans. Special enrollment periods are also available outside of the open enrollment window for individuals experiencing qualifying life events, ensuring continuous access to coverage options.

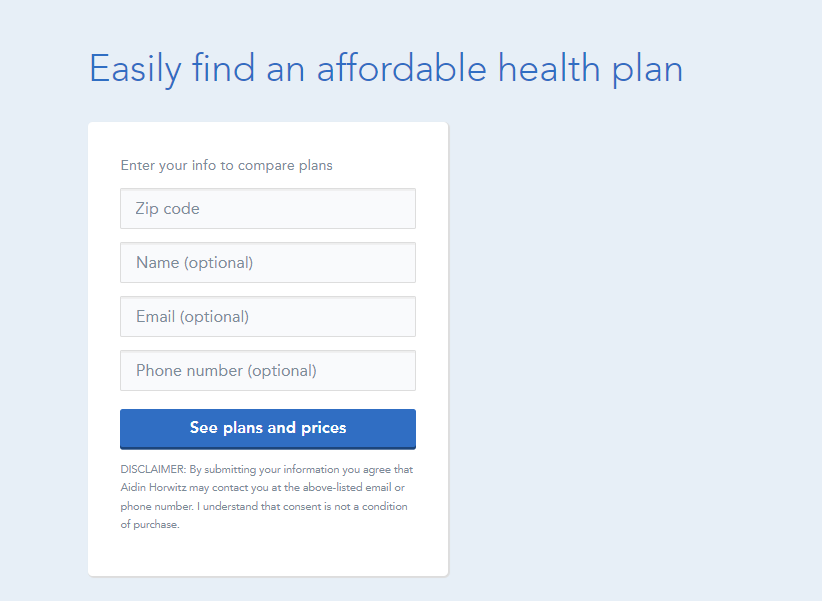

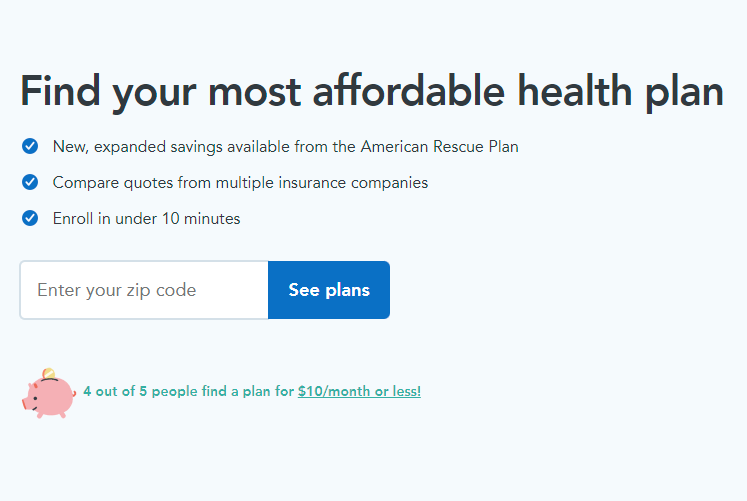

For streamlined navigation and assistance with plan comparison and enrollment, Mississippi residents can utilize online platforms like HealthSherpa. These resources provide tools and support to simplify the process of finding and applying for health insurance, helping individuals make informed decisions about their coverage needs and financial options.

Medicaid in Mississippi

Medicaid plays a crucial role in providing healthcare coverage to low-income individuals and families in Mississippi. Administered jointly by the federal government and the state, Medicaid offers comprehensive benefits to eligible residents, including doctor visits, hospital stays, prescription medications, preventive care, and more. The program serves various groups, including pregnant women, children, seniors, and individuals with disabilities, ensuring access to essential healthcare services for those who may otherwise struggle to afford them.

Eligibility for Medicaid in Mississippi is primarily based on income and household size, with specific guidelines set by the state. The program has expanded under the Affordable Care Act (ACA), allowing more low-income adults to qualify for coverage.

Mississippi residents can apply for Medicaid through the state’s Division of Medicaid or through the federally facilitated Marketplace. The application process typically involves providing information about household income, assets, and other relevant details. Once approved, enrollees gain access to comprehensive healthcare services, providing financial protection against the high costs of medical care. For individuals in need of healthcare coverage and financial assistance, Medicaid serves as a lifeline, ensuring access to vital medical services and promoting better health outcomes for vulnerable populations.

Children’s Health Insurance Program (CHIP) in Mississippi

The Children’s Health Insurance Program (CHIP) in Mississippi, known as CHIP Mississippi, offers healthcare coverage to uninsured children in families that earn too much to qualify for Medicaid but cannot afford private insurance. This program provides essential medical services to children under the age of 19, including doctor visits, immunizations, hospitalizations, prescription medications, and dental and vision care. CHIP aims to ensure that children have access to the healthcare they need to thrive and grow into healthy adults.

CHIP Mississippi follows federal guidelines set by the Centers for Medicare & Medicaid Services (CMS) and is administered by the Mississippi Division of Medicaid. Eligibility for CHIP is based on factors such as family income, household size, and age of the child. Families with children who meet the eligibility criteria can apply for CHIP through the state’s Division of Medicaid or through the federally facilitated Marketplace. Once enrolled, children receive comprehensive healthcare coverage, allowing them to access preventive care and treatment for illnesses or injuries without financial barriers.

For families in Mississippi who struggle to afford private health insurance but do not qualify for Medicaid, CHIP provides a vital safety net, ensuring that children receive the medical care they need to thrive. By covering a wide range of healthcare services, including preventive care and specialty treatments, CHIP helps families maintain their children’s health and well-being. Families interested in CHIP can explore their eligibility and apply through the state’s Division of Medicaid website or seek assistance from healthcare navigators or enrollment specialists.

Medicare in Mississippi

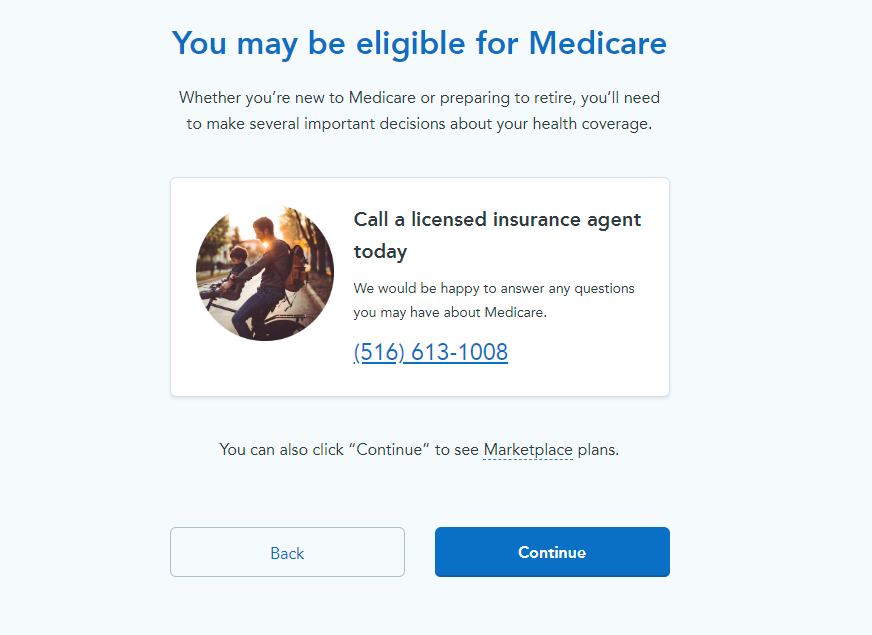

Medicare in Mississippi provides essential health coverage for eligible individuals aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions. Administered by the federal government, Medicare is a nationwide program that helps millions of Americans access healthcare services. In Mississippi, Medicare beneficiaries have access to a range of coverage options to meet their healthcare needs.

Original Medicare, consisting of Part A (hospital insurance) and Part B (medical insurance), forms the foundation of Medicare coverage in Mississippi. Part A helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Part B covers doctor visits, outpatient services, preventive care, and durable medical equipment. Beneficiaries have the option to enroll in additional coverage through Medicare Advantage (Part C) plans, which are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare and may include additional benefits such as prescription drug coverage (Part D), vision, dental, and wellness programs.

Medicare beneficiaries in Mississippi also have the option to supplement their coverage with Medicare Supplement Insurance (Medigap) plans, which help cover out-of-pocket costs such as deductibles, copayments, and coinsurance. Medigap policies are offered by private insurance companies and can provide additional financial protection against high healthcare expenses. With various coverage options available, Medicare beneficiaries in Mississippi can choose the plan that best meets their healthcare needs and budget. Click on the link below to see if you qualify or call (833) 703-2758 to speak directly with a Medicare specialist.

Or Call (833) 703-2758

Employer-Sponsored Insurance in Mississippi

Employer-Sponsored Insurance (ESI) represents a vital avenue for accessing health coverage in Mississippi. Many employers across the state provide ESI as part of their benefits package, offering employees and their families access to comprehensive healthcare coverage. ESI plans typically encompass various benefits, including medical, dental, vision, and prescription drug coverage, tailored to address the diverse healthcare needs of employees.

For Mississippi residents seeking health insurance, ESI presents an attractive option due to its convenience and potential cost savings. With ESI, employers often negotiate group rates with insurance providers, leading to lower premiums compared to individual plans. Moreover, some employers contribute a portion of the premium cost, alleviating the financial burden on employees. ESI plans also grant access to a network of healthcare providers, ensuring individuals can receive care from preferred doctors, specialists, and hospitals.

To obtain ESI in Mississippi, individuals usually need to be employed by a company that offers health insurance benefits. During designated enrollment periods or upon starting a new job, employees have the opportunity to enroll in ESI plans or adjust their existing coverage. Employers may furnish informational sessions or materials to assist employees in understanding their health insurance options and making informed decisions. By leveraging ESI offerings, Mississippi residents can secure comprehensive health coverage for themselves and their families while benefiting from employer-sponsored benefits.

Private Health Insurance Plans

Private health insurance plans offer Mississippi residents the opportunity to customize their healthcare coverage according to their specific needs and preferences. These plans, offered by private insurance companies, provide individuals and families with a range of options to ensure comprehensive medical care and financial protection. With private health insurance plans, policyholders have the flexibility to choose from various coverage levels, deductibles, and provider networks to tailor their insurance to their unique healthcare requirements.

To obtain private health insurance in Mississippi, individuals can explore different options available through insurance carriers websites, brokers, or online marketplaces. Comparing plans from multiple providers allows consumers to evaluate premiums, deductibles, copayments, and coverage benefits to find the most suitable plan for their needs. Additionally, some online platforms, like HealthSherpa, streamline the process of comparing and applying for health insurance by providing easy-to-use tools and resources. By utilizing these platforms, Mississippi residents can navigate the complexities of the insurance market and select a plan that meets their healthcare needs and budget constraints.

When considering private health insurance plans in Mississippi, individuals should carefully review the details of each plan, including coverage for essential health benefits, provider networks, and out-of-pocket costs. It’s essential to assess factors such as prescription drug coverage, preventive care services, and access to preferred doctors and hospitals. By conducting thorough research and understanding their options, Mississippi residents can confidently choose a private health insurance plan that provides the coverage and peace of mind they need for their healthcare journey.

Choosing the Right Health Insurance Plan

When it comes to navigating the process of getting health insurance in Mississippi, selecting the right plan is crucial. Here’s how to choose the right health insurance plan in Mississippi:

- Assess Your Needs: Begin by evaluating your healthcare needs and financial situation. Consider factors such as your medical history, anticipated healthcare expenses, and preferred providers. By understanding your requirements, you can narrow down the options to plans that best suit your needs.

- Compare Plans: Research the various health insurance plans available in Mississippi. Compare their premiums, deductibles, copayments, and coverage benefits. Look for plans that offer comprehensive coverage for essential healthcare services while also being affordable and within your budget.

- Check Provider Networks: Review the provider networks associated with each plan to ensure your preferred doctors, specialists, and hospitals are included. Choosing a plan with a broad network can give you greater flexibility and access to quality healthcare providers.

- Utilize Online Tools: Take advantage of online tools and resources to assist in your decision-making process. These platforms can help you compare health insurance plans side by side, making it easier to understand the differences in coverage and costs. These tools can also streamline the application and enrollment process, making it simpler to obtain coverage.

Additional Resources for Mississippi Residents

In addition to exploring health insurance options, Mississippi residents have access to various resources to assist them in obtaining coverage and navigating the healthcare system. Here are some additional resources for Mississippi residents seeking to understand how to get health insurance in Mississippi:

- Mississippi Division of Medicaid: The Mississippi Division of Medicaid provides information and assistance regarding eligibility and enrollment in Medicaid programs. Residents can visit their website or contact their local Medicaid office for guidance on applying for Medicaid coverage.

- Mississippi Insurance Department: The Mississippi Insurance Department offers resources and information on health insurance regulations, consumer rights, and assistance programs. Residents can visit their website or contact their office for help understanding insurance options and resolving insurance-related issues.

- Community Health Centers: Community health centers across Mississippi provide affordable healthcare services, including assistance with enrolling in health insurance plans and accessing preventive care. These centers serve as valuable resources for uninsured individuals and families seeking medical care.

- Healthcare.gov: Residents can visit Healthcare.gov, the federal health insurance marketplace, to explore health insurance plans, compare coverage options, and apply for coverage. The website also provides information on financial assistance programs for eligible individuals and families.

By utilizing these additional resources, Mississippi residents can access valuable support and guidance to navigate the process of obtaining health insurance coverage. Whether seeking assistance with enrollment, understanding insurance options, or accessing healthcare services, these resources can help individuals and families make informed decisions about their healthcare needs.

Conclusion: How to get Health Insurance in Mississippi with Confidence

Learning how to get health insurance in Mississippi is an empowering step towards securing not only your health but also your financial stability. Mississippi offers a broad spectrum of health insurance options, from private plans and employer-sponsored insurance to Medicaid and the Children’s Health Insurance Program (CHIP). Each option is designed to cater to the diverse needs and financial capabilities of its residents, ensuring that everyone has the opportunity to access necessary healthcare services.

To navigate health insurance in Mississippi with confidence, start by assessing your healthcare needs and financial situation. Whether you’re an individual looking for coverage or a family planning for the future, understanding your unique requirements is crucial. Utilize the wealth of resources available, such as Mississippi’s Health Insurance Marketplace, Medicaid, CHIP, and assistance from navigator organizations, to explore your options. Comparing plans, understanding the benefits, and knowing the costs involved are essential steps in making an informed decision.

Remember, the right health insurance plan is out there for you. By taking advantage of online comparison tools and seeking guidance from professionals when needed, you can simplify the process of finding a plan that fits your needs. Health insurance is more than just a policy; it’s a pathway to peace of mind and a healthier, more secure future.