Welcome to our comprehensive guide on “How to get Health Insurance in 2024.” Navigating the complexities of health insurance can often seem like a daunting task, but with the right information and guidance, securing the coverage you need doesn’t have to be overwhelming. Let’s embark on this journey together to ensure you and your loved ones are protected in 2024.

Table of Contents

Assessing Your Health Insurance Needs

Embarking on this journey begins with a clear assessment of your individual health insurance needs. This critical step ensures you select a plan that aligns with both your healthcare priorities and your financial constraints.

Essential Aspects to Consider:

- Current Health and Medical Background: Examine your present health condition, ongoing medical needs, and your family’s health history to anticipate the level of coverage required.

- Financial Planning for Insurance: Account for the costs associated with health insurance, including monthly premiums and potential out-of-pocket expenses like deductibles and copays.

- Life Changes on the Horizon: Reflect on any significant life milestones you anticipate in 2024, such as changes in family status or employment, which could influence your insurance needs.

Next, we’ll explore the diverse range of health insurance options available to you, from employer-sponsored plans and marketplace offerings to other options.

Exploring Health Insurance Options

Understanding Your Health Insurance Options for 2024

It is important to have a clear picture of all the avenues available for health coverage. Each option caters to different circumstances and knowing what each entails will help you navigate towards a choice that best suits your situation.

Employer-Sponsored Insurance

For those who have access to health insurance through their job, employer-sponsored plans can offer a convenient and cost-effective way to secure coverage. These plans typically come with a portion of the premium paid by the employer, potentially providing a broad range of benefits. It’s worth noting, however, not everyone has this option, and the choice of plans may be limited. If you are employed, you should speak with your employer to better understand your options. If you do not have access to employer-sponsored insurance or don’t want to go that route, no worries, we have more options for you below!

Health Insurance Marketplace

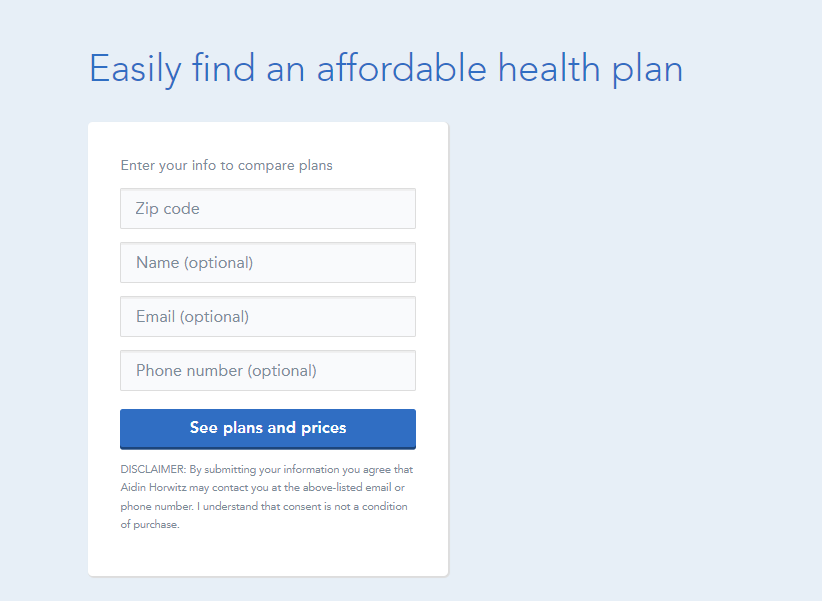

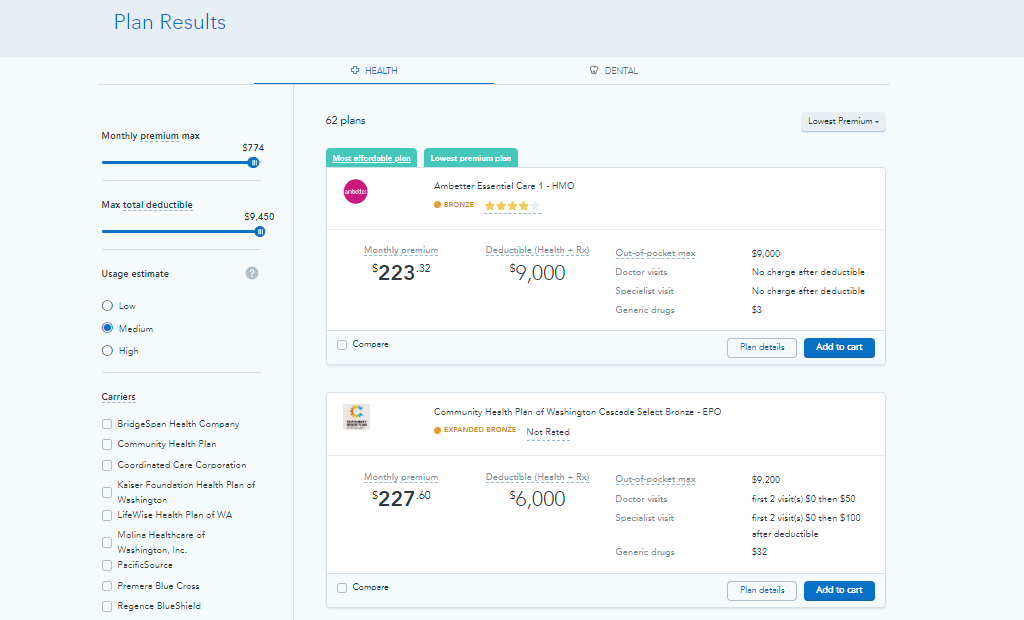

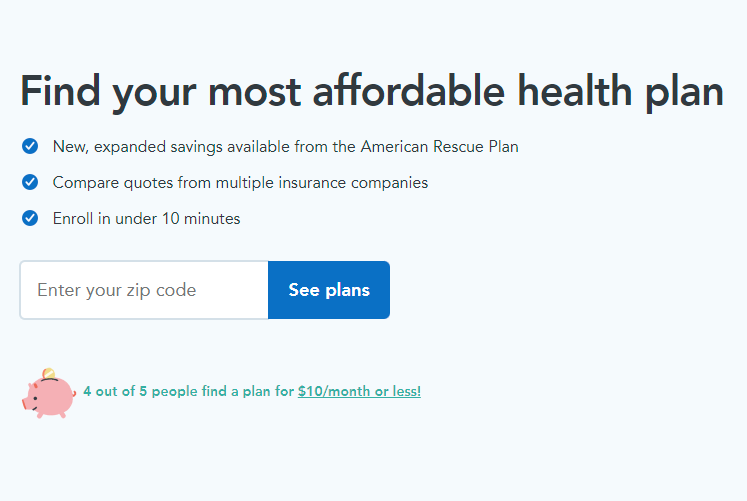

The Marketplace is a central platform where individuals can compare and shop for health insurance plans if employer-sponsored insurance isn’t an option or if they’re looking for more choices. It’s designed to simplify the search for coverage, offering a variety of plans with different levels of benefits and costs. Subsidies may be available to make premiums more affordable, based on your income. For those seeking personalized health insurance plans, I recommend checking out HealthSherpa. This platform is a trusted partner of the Marketplace, known for its straightforward comparison tools that help individuals find coverage that fits their needs and budget.

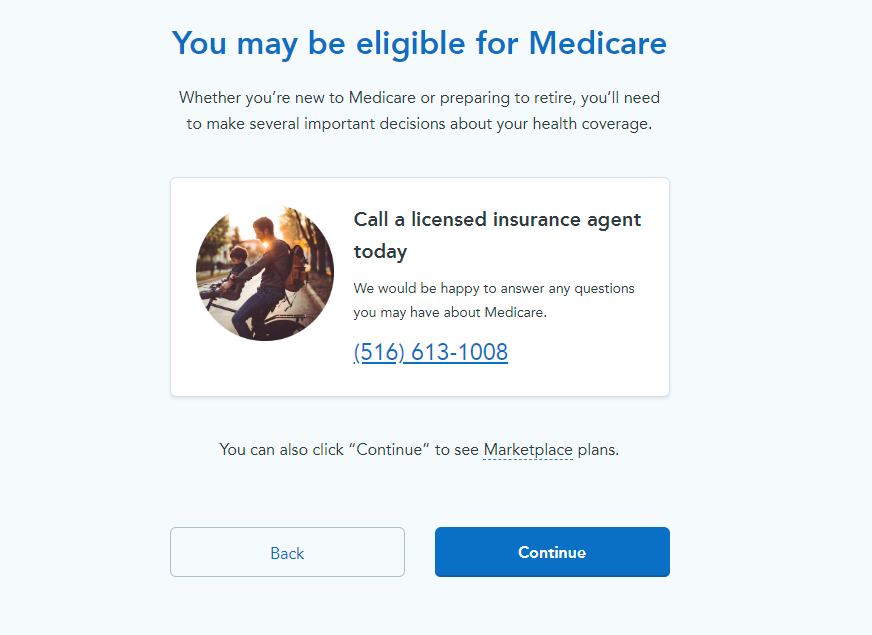

Medicare

Medicare is a federal program primarily for people aged 65 and older, but it’s also available to some younger individuals with specific disabilities. It covers a wide range of healthcare services, divided into parts that include hospital insurance, medical insurance, and prescription drug coverage. Eligibility criteria apply, and it’s a critical option for those who qualify. Click on the link below to see if you qualify or call (833) 703-2758 to speak directly with a medicare specialist.

Or Call (833) 703-2758

Medicaid

Medicaid provides health coverage to eligible low-income individuals and families, offering a comprehensive set of benefits. Eligibility for Medicaid varies by state, covering a range of services often at low or no cost to the recipient. This option is crucial for those who meet the income requirements.

Direct Purchase from Insurers

Purchasing health insurance directly from an insurance company is another route. This option can offer more personalized plans that might not be available through the Marketplace. While it allows for a direct relationship with your insurer, comparing plans and costs independently requires diligence. To gain a clearer understanding of this option, you can visit the websites of various insurance companies in your area.

Each health insurance pathway has its own set of benefits, considerations, and eligibility requirements. Whether you have access to employer-sponsored insurance or are exploring the Marketplace, Medicare, or other options, understanding the specifics of each can guide you to a decision that aligns with your healthcare needs and financial situation.

Evaluating and Comparing Plans

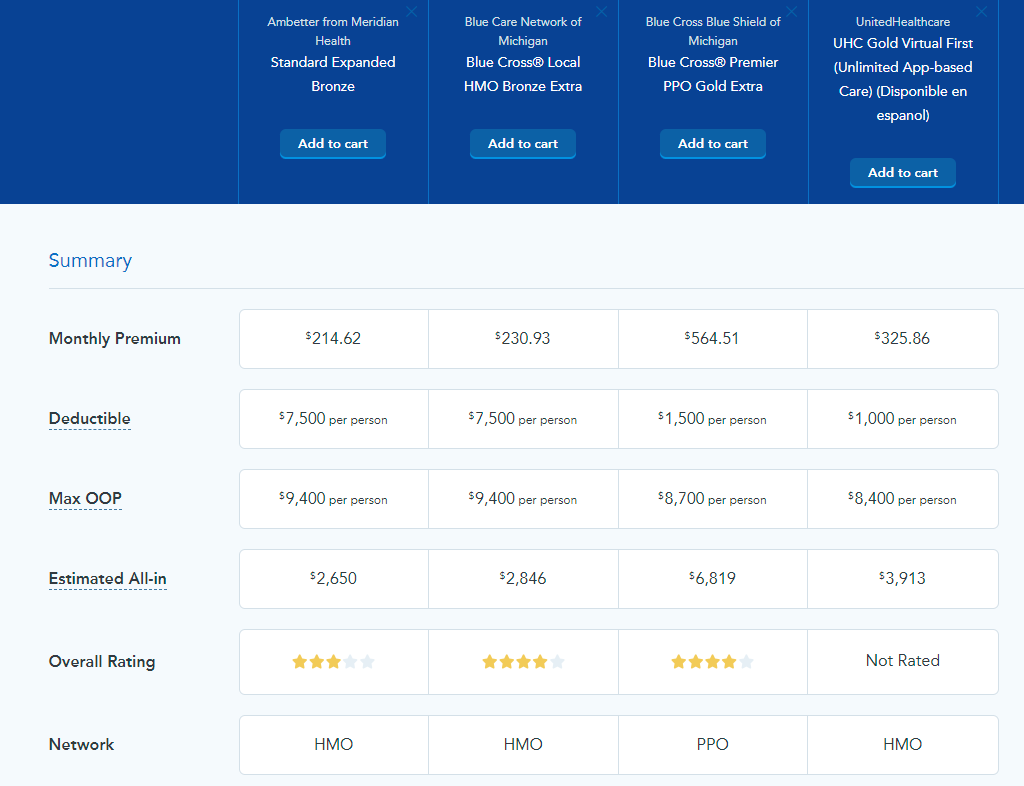

When it comes to “How to get Health Insurance in 2024,” selecting the right plan requires a careful evaluation and comparison of the options available to you. Here’s how to approach this crucial step to ensure you find a plan that best fits your healthcare needs and budget.

Understand Plan Types: Familiarize yourself with the different types of health insurance plans, such as HMOs, PPOs, EPOs, and POS plans. Each has its own network rules, provider choices, and referral requirements, affecting how you receive and pay for care.

Compare Coverage Details: Look closely at what each plan covers, including preventive services, prescription drugs, hospital care, and specialist visits. Ensure the plans you consider meet your anticipated healthcare needs.

Assess Costs Beyond Premiums: While premiums are important, also examine deductibles, copays, coinsurance, and out-of-pocket maximums. These costs significantly impact your overall healthcare spending.

Review Provider Networks: If you have preferred doctors or healthcare facilities, check if they are in-network for the plans you’re considering. Staying in-network typically costs less than using out-of-network providers.

Check Drug Formularies: If you need prescription medication, ensure the plans cover your drugs. Formularies can vary widely, and some plans may offer better coverage for your medications than others.

Consider Additional Benefits: Some plans may offer extra benefits like wellness programs, mental health services, or telehealth visits. These can add value and convenience to your coverage.

Use Comparison Tools: Many health insurance marketplaces and company websites offer tools to compare plans side-by-side. These can help you visualize differences in coverage, costs, and benefits.

By methodically evaluating and comparing health insurance plans, you can make an informed decision that aligns with your health needs and financial situation. Remember, the best plan for you balances comprehensive coverage with affordable costs, fitting seamlessly into your life.

How to get Health Insurance in 2024 – Wrap up

It’s clear that securing the right health insurance is a critical step toward safeguarding your health and financial well-being. With the insights and steps outlined, you can navigate the health insurance landscape, assess your needs, explore your options, evaluate and compare plans, and confidently apply for coverage that suits you best.

Take Action Now: Don’t wait to start this important process. Health insurance is more than just a safety net; it’s a vital investment in your and your family’s future. Begin by assessing your healthcare needs and budget, then explore the options available to you, whether through an employer, the Health Insurance Marketplace, Medicare, Medicaid, or direct purchases from insurers.

Stay Informed: Health insurance policies and offerings can evolve, so it’s essential to stay informed about changes that could affect your coverage or opportunities to save money. Regularly review your plan and keep an eye on enrollment periods to make timely adjustments.

Seek Assistance If Needed: If you’re unsure about which plan to choose or how to apply, don’t hesitate to seek help. Insurance agents, navigators, and state health insurance assistance programs can provide valuable guidance tailored to your specific circumstances.

Where to Apply: Begin your application journey by clicking Here for Marketplace plans or Here for Medicare and Medicaid. For other options, reach out directly to the relevant organizations or insurance providers.

Remember, the effort you put into getting health insurance in 2024 is an investment in your peace of mind and health. Take the first step today towards a healthier, more secure tomorrow.

Additional Resources

To further assist you in your journey to “How to get Health Insurance in 2024,” we’ve compiled a comprehensive resource that details the application process for health insurance in each state. Whether you’re looking for specific state marketplace information, need to understand how to apply for Medicare and Medicaid, or seeking details on employer-sponsored insurance and direct purchase options in your state, this resource has you covered.

Below, find a link to every state with more detailed guides on applying for health insurance within that particular state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

This Health Insurance guide is designed to make your search for the right health insurance as straightforward as possible, providing you with state-specific information to help you make an informed decision. You should never need to ask how to get health insurance again.

Securing Your Health Insurance for 2024

Taking proactive steps toward securing health insurance is imperative for protecting both your health and financial stability. The journey through assessing your needs, exploring diverse insurance options, evaluating and comparing plans, and finally applying for the right coverage is a testament to the importance of being well-informed and prepared.

Health insurance stands as a critical pillar in your overall well-being strategy, offering peace of mind that you and your loved ones are protected against unforeseen health issues and financial burdens associated with medical care. The effort you invest today in securing health insurance for 2024 is a direct investment in your future health and prosperity.

Embrace the Process: Start by thoroughly assessing your healthcare needs and financial capacity, then delve into the variety of health insurance options available. Whether it’s through an employer, the Health Insurance Marketplace, Medicare, Medicaid, or direct purchases, there’s a solution tailored to your unique circumstances.

Stay Proactive and Informed: The landscape of health insurance is ever-evolving. Staying abreast of changes within your plan, the market, or legislation can help you adapt and make informed decisions that ensure your coverage remains aligned with your needs.

Seek Guidance When Needed: Navigating the world of health insurance can be complex. Don’t hesitate to reach out for assistance from professionals or utilize state-specific resources to guide your decisions.

Action is Key: Armed with the knowledge and resources provided in this guide, you’re now ready to take the next steps. Begin your application process by visiting the recommended links to the Health Insurance Marketplace or Medicare, and explore state-specific guides to ensure you’re making the best choices for your situation in 2024.

Remember, the path to securing health insurance may seem daunting, but it’s a journey worth undertaking. By making informed decisions and taking action now, you’re setting the stage for a healthier, more secure future. Start today, and step confidently into tomorrow knowing you’re covered.